The results of the Unified Advertising Market Barometer (BUMP) for the first half of the year were released on September 10 by Kantar Media, Irep and France Pub. The year 2014 is a good year for the players in the sector.

Trust is established and the recovery is clear. According to the Bump, Net advertising revenues from all media amounted to 8.44 billion euros in France in the first half of the year, a significant increase (+9.3%) compared to 2023. The results of the advertising, media and communications market reflect the enthusiasm of advertisers in preparing for the major sporting events of the year, even if the Olympic period is not included in the figures announced. “This positive acceleration of the advertising market in the first half of 2024 is due to a combination of favorable economic and sporting factors as well as the strong dynamics of digital as a whole and within each of the media,” explained Christine Robert, Deputy Director of Irep, during the presentation. Across the scope of the 5 media (television, cinema, radio, press, outdoor advertising including digital media revenues), net advertising revenues amount to 3.281 billion euros, up +6.1% compared to H1 2023.

©Mongkolchon – stock.adobe.com

The selective and soft focused image of businessman is going to sign the contract in the business meeting.

Digital, stronger than in 2019

As a renewed trend, digital is taking a large share in the market growth. Thus, the performance of cumulative digital net revenues from television, press, radio and DOOH amounted to 466 million euros with sustained growth of +22.2% compared to H1 2023, largely exceeding the first half of 2019 (at +68.7%).

The winners and the losers

In detail, net digital revenues from television, press and radio continued their sustained momentum of +20.4%, largely exceeding S1 2019 at +76.3%. The digital formats of these 3 media are in continuous acceleration : for the audio format (+23.8% vs. S1 2023) and even more for the video format (+29.8% vs. S1 2023). Including DOOH, the cumulative digital revenues of the 4 media strengthen their growth to +22.2% vs. S1 2023. Over the period, outdoor advertising, television and radio show positive results. Outdoor advertising shows double-digit growth vs. S1 2023 at +10%. The positive growth of this media is reflected for the first time on all levers since the Covid crisis: shopping still in strong growth at +23.5% vs. H1 2023, transport at +13.4%, outdoor in positive this half-year at +7%, street furniture at +6.7%. The DOOH segment, still in excellent health, is growing by +26.7%. Television is back to very sustained growth at +8.3% vs. H1 2023; this growth allows it to exceed its H1 2019 level with +0.6%. Radio, still in good shape, is continuing its momentum at +2.9%. Conversely, The press, cinema, advertising mail (-4.9%) and ISA (-12.1%) (unaddressed printed matter) are showing declines more or less accentuated. Advertisers have responded. The period brought together 43,714 brands having communicated during the period. Only paid search, outdoor advertising and print see the number of advertisers decline while all other channels (linear TV, display, digital audio, digital outdoor advertising, cinema, IPTV replay) attract a growing number of brands.

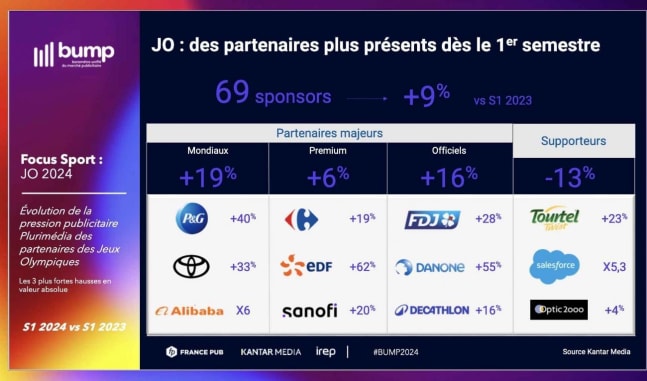

An Olympic year

Beyond the semester, all these sponsors and many other advertisers continued to invest throughout the summer with significant figures, such as 130.8 million gross revenue generated in television during live broadcasts. These brands will contribute to the overall performance of the year 2024. Thus, the communications market is expected to reach 35.9 billion euros in 2024, an increase of +5.3% compared to 2023The growth of the 5 media of +4% would be higher than its medium-term annual trend, thanks to the contribution of the 2024 Olympic Games and the effects of the diversification of the offer (development of streaming platforms and increasing digitalization of outdoor advertising). With a growth of +8.2%, digital would exceed by more than 50% the level reached in 2019. The evolution of other media would be exceptionally boosted in 2024 by the cyclical contribution of sports sponsorship. In this group of media, advertisers’ investments would reach a growth of +4.2%, but would remain -8.2% lower than those of 2019.

Source: www.e-marketing.fr