One of the most important things when taking out a loan is understanding your effort rate, that is, what you can pay without compromising your financial stability. This is essential to avoid situations of default in the future.

The effort rate is a fundamental concept for anyone considering taking out a loan, whether for the purchase of a house, a car, or any other type of personal credit.

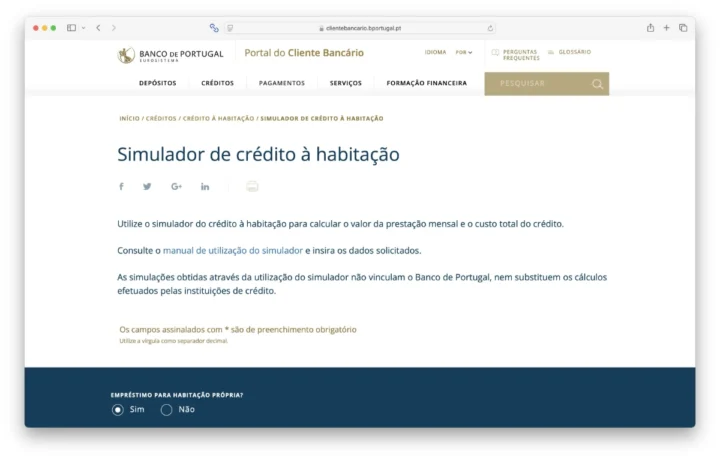

This is a financial indicator that measures the proportion of a household or individual's monthly income that is allocated to paying loan installments. Understanding the effort rate and its effects is crucial to ensuring healthy financial management and avoiding situations of over-indebtedness. You can do a simulation on the Banco de Portugal website to see how far you can go.

The effort rate represents the percentage of a person or family's net monthly income that is allocated to paying off debts or loan installments.

In simple terms, it indicates the financial burden that loan repayments have on a household's monthly budget. For example, if a person or family has a monthly income of 2,000 euros and pays 600 euros in loan installments, their effort rate will be 30%.

In Portugal, most of the financial institutions consider that an effort rate between 30 and 35% is acceptable. This means that it is the maximum percentage of a household's net monthly income that must be allocated to repaying loans. However, in exceptional cases, the effort rate may be allowed to reach up to 40%, especially if the person or family has high income and other assets that reduce the risk of default.

Things to consider when taking out a loan

- Assess payment capacity: Before taking out a loan, it is essential to realistically assess your repayment capacity. The effort ratio is an excellent tool for this purpose. If the effort ratio is already close to 30%, it is advisable to reconsider the need to take on new financial burdens, as this could jeopardize your financial stability.

- Consider interest rate variations: many loans, especially mortgage loans, have variable interest rates, which means that repayments can increase over time. It is important to simulate the impact of possible interest rate increases on the loan repayment and, consequently, on the effort rate. A repayment that is affordable today may become unsustainable in the future.

- Set aside a margin for unforeseen events: You should never commit all of your disposable income. Unforeseen expenses, such as medical expenses or home repairs, can arise at any time. It is prudent to ensure that, even after paying the installments, you have a comfortable margin to cover other expenses and savings.

- Plan for the long term: A loan, especially a mortgage, is a long-term commitment. When calculating the effort rate, one must consider not only the current financial situation, but also possible future changes, such as retirement, job changes or the need to support children or dependents.

Consequences of a high effort rate

A high debt burden can have several negative consequences. The most obvious is the risk of default, where the debtor is unable to meet their financial obligations, resulting in seizure or loss of assets. In addition, a high debt burden can lead to financial stress, affecting emotional well-being and quality of life.

Remember that this is an essential indicator in financial management and decision-making about taking out credit. Keeping the effort rate within reasonable limits is essential to ensure a balanced financial life and avoid the risk of over-indebtedness.

Source: pplware.sapo.pt