Frasers Group: Digital transformation with a data-first approach

For Frasers Group, one of the UK’s most successful sports, premium and luxury retail groups, which includes Sports Direct, House of Fraser, Evans Cycles, Jack Wills, USA Pro and Sofa.com, customer engagement began with digital transformation. This involved implementing a fundamental technology infrastructure across the company to better capture data and automate systems in a consistent manner. This involved a significant shift in mindset and culture towards agility. The goal was to collect data, activate data and monetise data. This enabled Frasers to significantly improve the customer experience. This included optimised product delivery, cross-channel personalisation and the ability to provide customers with relevant experiences based on location.

In addition, the retailer introduced the Frasers Plus Pay loyalty program. Participants have the opportunity to purchase products from brands across the group while collecting loyalty points that they can redeem for personalized offers.

Thanks to the combined benefits, including payment in instalments, Frasers Group was able to increase the average order value of Frasers Plus Pay members by 40 percent compared to non-members, and 25 percent of new members made purchases from various Group brands within five months of launch.

John Lewis Partnership: Score points with the right level of customer loyalty

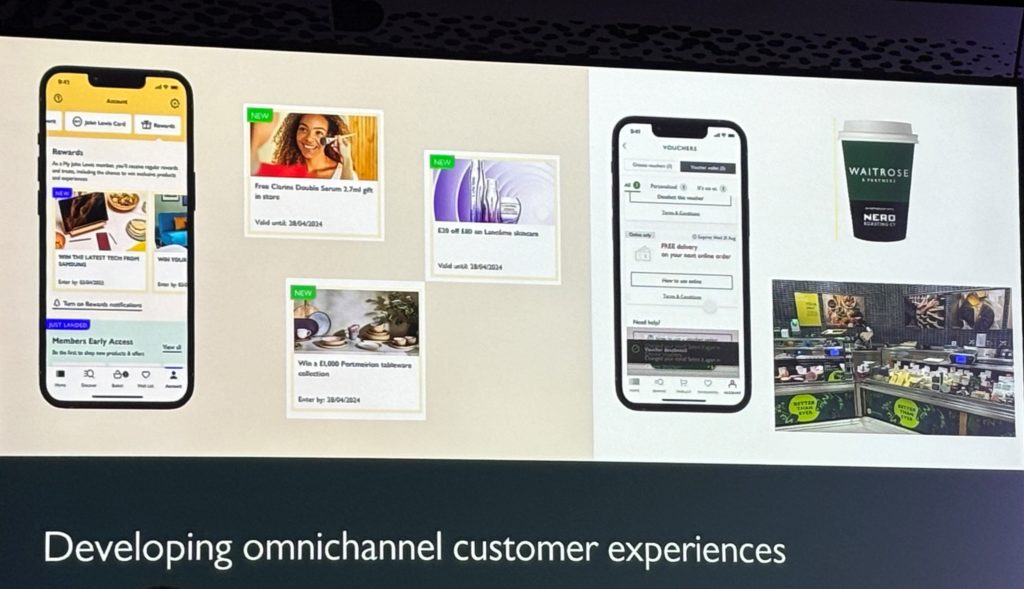

John Lewis Partnership is one of the UK’s largest retailers and operates the two well-known retail brands John Lewis and Waitrose. The company owns 34 John Lewis shops and one outlet, as well as 329 Waitrose supermarkets. Loyalty in this context can vary greatly depending on the customer’s relationship with the brand: for example, consumers have a stronger emotional connection to their favourite sports club than to a retail company. The strategy is therefore to align all loyalty mechanisms with the type of loyalty that customers are likely to value most and respond to best.

For example, a functional way of engaging customers – based on points or subscriptions – can positively influence customer behavior in supermarkets. In contrast, brands with a more emotional component find that customers are more likely to engage with content and activities that foster a deeper relationship and make them feel special. For example, the John Lewis brand wants to keep surprising its loyal fans with great offers to keep them loyal, while Waitrose often relies on “member benefits.”

For both brands, as different as they may be, getting loyalty right is a top priority. It is important to see loyalty as part of a comprehensive customer retention strategy, not just as a mechanical system. In addition, it is essential to look beyond your own products and services to offer real benefits to loyal customers. Incorporating partners and suppliers into the loyalty program can significantly increase the value of offers and rewards and increase the likelihood that customers will return and stay loyal to the brand.

RMS Beauty: Community-based cashback program

RMS Beauty, a US early mover in the clean beauty movement, experienced a flop with its first customer loyalty program. Reason enough to adopt a new strategy and research what really makes the typical RMS customer tick. The brand found that a community-based cashback program was most popular with customers. RMS then collected zero-party data and used it to personalize offers and communication.

To do this, RMS Beauty used methods such as surveys, feedback and registration forms. By combining zero-party and first-party data, the brand was able to use machine learning to predict customer behavior and segment audiences for better targeting. By continuously monitoring key performance indicators and customer feedback, RMS Beauty’s new loyalty program became relevant to customers and was well received. Since its launch, RMS Beauty has achieved impressive results: the participation rate in the customer loyalty program has increased by 450 percent compared to the industry average.

Conclusion: Three strategies that strengthen brand loyalty

While Frasers Group, John Lewis Partnership and RMS Beauty use different approaches to improve customer loyalty, they pursue three similar strategies:

- Truly understanding the customer: A good loyalty approach must always be based on an analysis of customer loyalty to the brand.

- Be personal and relevant: A simple points system is not enough. Those who use customer data to develop rewards that are best received by different customer segments are certainly at an advantage.

- Loyalty must work across all contact points: It is crucial that the loyalty program is present at every stage of the customer journey, be it on the website, mobile app, in-store, social media or at events.

Source: onlinemarketing.de