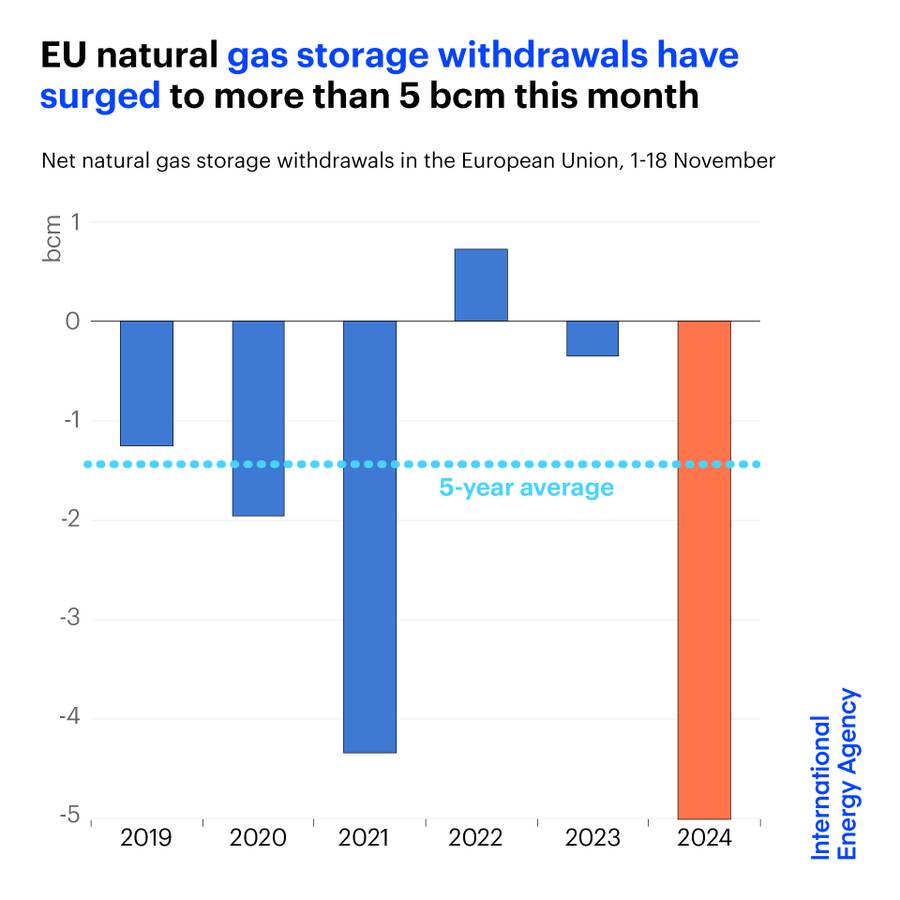

EU countries are using up gas from underground storage facilities at a record pace – much faster than in previous years. Experts do not rule out that prices will continue to rise: the coming winter promises to be the coldest since the start of a full-scale war in Ukraine. In addition, the transit of Russian gas through it may cease. Could this drive up prices in Estonia again? Will the protective mechanisms introduced by the EU after the last energy crisis work?

The situation is complicated by the record-breaking rapid depletion of underground gas storage facilities (UGS), which began after the first frost. In addition, the summer drought has now affected hydroelectric power generation, also increasing demand for gas.

Denmark has the least reserves (68%), followed by the Netherlands – 76%. Estonia does not have its own underground gas storage facility; it uses Inčukalnskoye in Latvia, where 77% remains, and this is the third place in the ranking of the least secure. In Germany, at first glance, everything is not bad – 92%. But in the country, many factories have already had to stop or reduce production due to high energy prices. The accelerated withdrawal of stocks from storage therefore sends an alarming signal that the pressure on Europe’s largest economy continues for the third year in a row.

Another cause for concern is the uncertainty over future pipeline gas supplies from Russia. The contract for its transit, signed by the Russian Gazprom and the Ukrainian Naftogaz, expires on December 31. The parties have long announced that they do not agree to sit down at the negotiating table with each other. A month before the deadline, the real decision was still not officially presented.

So far, several options are being discussed at the level of statements – mediation by Slovakia, replacement of Russian gas with Azerbaijani or Turkish gas with a complete cessation of supplies from Russia. Hungary warns that its energy security is under threat.

“I do not expect gas prices in Europe to rise significantly as overall demand is about 20% below the five-year average (2017-2021) and Russian gas supplies to some buyers in Central Europe have fallen significantly. For example, last year they amounted to less than 14 billion cubic meters or less than 10% of Russia’s total exports to Europe before the war in 2021, says Aura Sabadus, an expert on energy and cross-products at the international analytical organization ICIS. “However, while there is no fundamental reason for prices to rise to unreasonable levels, it is possible that the end of the transit agreement could create volatility, meaning prices could begin to fluctuate widely.”

“If we really want to be independent from Russian gas, we need to have more import capacity, and we will probably see that again this winter because gas storage is being emptied quite quickly as we have a cold start to winter,” says the CEO of the German energy company RWE AG Markus Krebber.

Europe will not be left completely without gas and will not face the need for austerity – more austerity than what it has already had to do, this is the most common opinion among experts. It is possible to replace Russian gas. However, these will be more expensive contracts and possibly some supply disruptions. For LNG you will have to compete with buyers from Asia, charging higher prices. These problems will not affect end consumers, but will lead to additional price increases.

Bloomberg analysts point to such a parameter as gas prices for delivery next summer. By this time, storage facilities will need to be refilled and, as a rule, this is a season of low prices. They are now higher than in the summer of 2024.

“Demand remains low at the household level and, according to the latest report, there is very modest growth in the industrial sector,” comments Aura Szabadus. Storage facilities in most European countries are 80–90% full, and although this is 10 p.p. lower than in 2023-2022, but still higher than in the 2017-2021 period, Sabadus says.

“The onset of cold weather in continental Europe has indeed led to an accelerated withdrawal of gas from storage and much will also depend on the weather forecast for the remaining winter months,” she admits.

“Although Russian transit through Ukraine accounts for about 5% of Europe’s total imports, interruption of transit could lead to further price volatility,” the expert agrees. “And yes, we expect a surge in LNG use from the second half of 2025 and even more from 2026, reflected in 2026 prices currently hovering around €10.00/MWh below current levels.”

“We are already seeing gas prices affected by geopolitical events (Russian full-scale war in Ukraine, conflict in the Middle East) and this trend is likely to continue, especially if we see more geopolitical turbulence in the coming months/years. This will affect the price of LNG sold on the world market. This could lead to higher prices, but this is likely to be short-lived given that more LNG is expected to be supplied to global markets in 2025,” explains Sabadus.

As for Estonia, which does not receive Russian gas either through Ukraine or through any other infrastructure, all price shocks will reach it through the common market, and indirectly it will face all the consequences of geopolitical events, Sabadus summarizes.

Related articles

In Europe, the price of gas has shown a fluctuating upward trend over the past nine months, rising by as much as 20% in November.

This year the Baltic region will not experience a gas shortage, assured the Conexus Baltic Grid company, which manages the Latvian underground gas storage facility in Incukalns.

The price of energy is a key factor in the competitiveness of an economy and should therefore be central to policy making. We have clearly defined responsibilities in ensuring the transition to green energy, but it is difficult to find someone responsible for competitive energy prices, writes former head of Eesti Energia Hando Sutter.

The publicly traded investment company Infortar, through its subsidiary Eesti Gaas, is acquiring the entire Polish business of the German energy group for 120 million euros.

No one is surprised by the fact that cybercriminals are interested in government agencies or providers of vital services. However, what will probably come as news to many is that small businesses—often even their own businesses—are under attack every day.

Source: www.dv.ee