Mobile-review.com editor’s note. We select materials for the “Opinion” section to show how companies in other countries perceive the market. The opinions in such materials often do not coincide with the views of our editorial staff, but they provide an understanding of the market and its media component.

Based on materials Bloomberg

Gallium and germanium are important metals, although not widely known. And now they have become the latest defendants in the increasingly escalating trade war between the United States and China. On December 3, China announced a ban on exports of both metals to the United States in retaliation after President Joe Biden’s administration imposed new technological restrictions on the country. Beijing initially imposed export controls on these materials last year, pushing up prices and redirecting trade flows.

What are gallium and germanium?

Both substances are silvery-white in appearance and are generally classified as “minor metals”. Gallium and germanium are not usually found in nature on their own. They are produced in small concentrations as a by-product in mining and processing plants targeting other, more common raw materials such as zinc or alumina.

How big is the market for them?

The market for these metals is tiny, especially compared to commodities like copper or oil. For example, U.S. imports of gallium metal and gallium arsenide wafers were valued at just $225 million in 2022, according to government data. But their use in strategic industries means that any supply disruptions could still have significant consequences.

What are gallium and germanium used for?

These metals have a wide range of specialized applications in chip manufacturing and in the communications and defense industries. Gallium is used in complex semiconductors, which combine multiple elements to improve transmission speed and efficiency. It is also needed for TV and phone screens, solar panels and radar equipment. Germanium is used in fiber optics, night vision goggles and space exploration. Most satellites are powered by germanium-based solar cells.

How important are supplies from China?

Trade flows in such small and niche markets are difficult to track, but China is by far the world’s largest supplier of both metals, accounting for 94% of gallium and 83% of germanium supplies, according to last year’s European Union study on critical raw materials. And while substitutes exist for both metals, the alternatives are much more expensive and can reduce performance in their intended applications, according to CRU Group, a provider of analytics to the metals industry.

Can other countries produce more?

Neither metal is particularly rare, but the cost of producing them is high. Because China has exported them relatively cheaply for so long, there are few facilities elsewhere producing these metals. As China increased its production, other countries, including Germany and Kazakhstan, reduced it.

Gallium prices have risen 80% since restrictions were announced last year, while germanium has more than doubled in price. If prices continue to rise, analysts expect other suppliers to ramp up production to meet demand.

Where else are these metals produced?

Outside of China, other gallium producers include Russia and Ukraine, where the metal is produced as a by-product of aluminum production, and South Korea and Japan as a by-product of zinc production. In North America, germanium is extracted along with zinc, lead and other metals at Teck Resources Ltd.’s Trail smelter. in British Columbia.

Also worth mentioning is the manufacturer of special materials 5N Plus Inc. and Indium Corp. in the USA. In Europe, the Belgian company Umicore SA is a producer of both metals.

Some mining operations with higher concentrations of metals, such as the Kipushi zinc project in the Democratic Republic of Congo, may also offer the opportunity to increase supplies. In the US, Trafigura Group’s Nyrstar unit is evaluating prospects for building a germanium plant in Tennessee.

Recycling can also be a key factor. Factory scrap already provides part of the supply of both metals. According to the US Geological Survey, germanium has also been recovered from the sighting devices of decommissioned tanks and other military vehicles.

So what does this all mean? (Editor’s note)

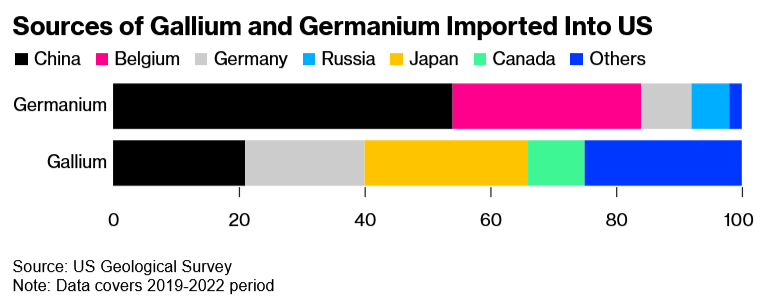

Overall, it appears that US industry has no reason to fear Chinese sanctions. But this would be a very superficial conclusion. In another Bloomberg material you can find infographics of the supply of these metals to American companies by country for 2019-2022.

If for gallium China is only one of the suppliers, albeit an extremely large one (more than 20%), then it is, of course, impossible to quickly make up for the loss of more than half of the germanium supplies. Also, the question is not covered in any way whether other suppliers of these metals can increase their production, in what time frame and how much it will cost. Strategic production depends little on the price factor, but commercial production may simply become unprofitable, even if the materials are delivered in the required time frame and volume. Of course, one cannot expect an immediate effect from this ban, but at least in the medium term, China will seriously complicate the life of many high-tech industries in the United States: a break in the supply chain, a broken rhythm, the need to test new samples, and more. As a result, we can expect a worldwide slowdown in the development of the high-tech industry, when the efforts of companies will go not to developing something fundamentally new, but to refining existing technologies using always available raw materials. This may be the true price of a pair of metals, the supply of which to the United States seemed to be limited to a couple of hundred million, completely unnoticeable against the backdrop of $3.4 trillion in American imports.

Source: mobile-review.com