ELECTROMOBILITY AS A KEY TO THE COMPETITIVENESS OF THE EUROPEAN AND SLOVAK ECONOMY

The GreenWay company joined the Opportunity 35 initiative. The campaign wants to strengthen the perception of electromobility as an opportunity, emphasize its potential for the European economy, employment and competitiveness, or respond to skeptical views that consider the electrification of transport unrealistic, too fast or uneconomical. Opportunity 35 emphasizes that the transition to electromobility is not only environmentally necessary, but also economically beneficial for Europe, which can benefit from the creation of thousands of jobs, reduced dependence on fossil fuels and more efficient transport.

GreenWay is the Slovak voice of electromobility in Brussels

“We want to convince the general public, as well as political leaders at home and in Brussels, that electromobility represents an opportunity for development and modernization, not just an expensive experiment with an uncertain outcome,” explains Peter Badík, director of GreenWay. As the only Slovak operator of charging services, it joined the initiative led by the leading European organizations ChargeUp Europe and AVERE. “Electromobility represents a transformational change that will change the entire European economy, therefore it is extremely important to develop this sector in such a way that it benefits European industry, but especially the people of Europe. GreenWay sees a wider picture, we perceive not only the environmental, but also the socio-economic and geopolitical significance of the shift away from fossil fuels, which Europe only has to a limited extent. For Slovakia’s economy, whose GDP is largely dependent on automotive performance, failure to manage this transformation could be the last nail in the coffin,” warns Badík.

Transformation cannot be dictated, but neither can it be stopped

“Electromobility is not some “alternative” way. Its development is the only way that Europe can remain strong in the automotive industry. The industry faces a difficult task to innovate, streamline development and production, and thus catch up with the new, predatory competition from China,” says Aaron Fishbone, GreenWay’s International Affairs specialist, adding: “The problem is not just cheap vehicles that come to us from Asia. A much bigger challenge for European manufacturers is the rapid decline in sales in the world’s largest automotive market. More vehicles are sold in China than in the US and Europe combined. Consumers in China are interested in technology-packed electric cars that European brands simply cannot deliver.

“If Europe also decided to include a backward step in its emission targets, it would not solve the problems of producers in any way. The megatrend of electrification of transport is not based on the decision of European officials, as some are trying to convince us. The essence is technological innovation. And such a change cannot be dictated, but neither can it be stopped. We can only use it or be crushed by it,” adds Badík.

GreenWay supports the long-term goal of developing electromobility on roads and in factories and calls on European leaders not to slow down, but to accelerate the reduction of emissions with the view of reaching zero by 2035. This goal is an important signal to investors that e-mobility will have solid foundations for the European market and will thus provide the necessary stability for further investments in innovative technologies and infrastructure development.

“We believe that an understanding of long-term technological trends will overcome the current negative sentiments in the European automotive industry, which must stop gambling with its future. We certainly do not want to live to see the time when car companies will demand billions from public resources to save themselves due to an unmanaged transformation,” concludes GreenWay CEO Peter Badík.

FAQ about electromobility in Europe

The main messages of the Opportunity35 campaign | opportunity35.eu

1. What is the current situation on the electric car market in Europe?

Electric car sales are still growing, although the growth rate has seen a slight decline for a number of reasons, but it should still not be considered a representative sample. Some factors that influence current sales numbers:

• Cancellation of subsidies in Germany: at the beginning of the year, Germany unexpectedly canceled subsidies for electric cars, which led to a year-on-year decrease in sales and affected the overall figures in the EU. Sales of electric cars in the EU-27 increased by 1% in the first half of 2024, but excluding Germany by up to 9%.

• Preparation for CO2 limits in 2025: European car manufacturers traditionally record lower sales in the year preceding the introduction of new CO2 limits in the EU, as they try to maximize sales only in the year when stricter limits start to apply. market a number of affordable models of electric cars, which will have a significant impact on sales.

• Analysts expect sales of electric cars to accelerate again in 2025. Instead of considering 2024 as a crisis situation that requires postponing the goals, politicians should focus on increasing the demand for electric cars by supporting and accelerating the expected growing trend (e.g. consistent national incentives, EU rules for leasing company vehicles, by abolishing customs duties on the import of electric cars).

2. Why is it important to comply with CO2 limits for cars in the EU?

• CO2 limits for the years 2025 to 2035 provide the necessary certainty for investors and guarantee a transparent and level playing field for European electric car manufacturers, the battery supply chain, charging station operators, software manufacturers and other related businesses.

• Limiting the predictability of the development trajectory would weaken the business arguments for investing in electromobility in a critical period when the development of the entire ecosystem (charging, leasing, secondary market) is needed.

• At the same time, the hesitation of Europe would bring China an opportunity to strengthen its position in the market of vehicles with “new” drives (more than 50% of sales in China are already made up of BEVs and PHEVs).

3. How can the EU improve competitiveness in the field of electromobility?

• Launching new funding at EU level under the Clean Industry Agreement to help address the competition gap. Key parts of the European electromobility ecosystem face it, especially the battery supply chain.

• Directing available resources to electromobility and limiting support for hydrogen and other marginal technologies in transport as soon as possible.

• Improving regulatory certainty through an action plan for the automotive industry. It is necessary to avoid new requirements and evaluate where existing requirements and regulations hinder competitiveness.

• Support for increasing the qualifications and retraining of the workforce in the automotive industry in the EU.

4. What is the economic potential of electromobility in Europe?

Huge. If European OEMs work together across the industry, they can strengthen their position as world leaders while supporting economic growth. With the right investments and partnerships, Europe can reap the benefits of EVs in the coming years – including a 13% increase in the economic contribution of the EU automotive value chain by 2035 in a best-case scenario.

5. Is electromobility responsible for the crisis in the automotive industry?

The transition to electromobility is not the cause of the crisis, but rather an opportunity for growth and development. Stopping or slowing down the transformation would mean the loss of competitiveness and leadership of the European automotive industry in an environment where electromobility is becoming dominant.

Five achievable goals in the transition to electromobility:

- Support for the growth of the entire electromobility ecosystem

- New investments in the sustainable automotive value chain

- Quality new jobs and opportunities for retraining

- Global leadership in the field of new technologies

- Sustainability at the forefront of the local supply chain

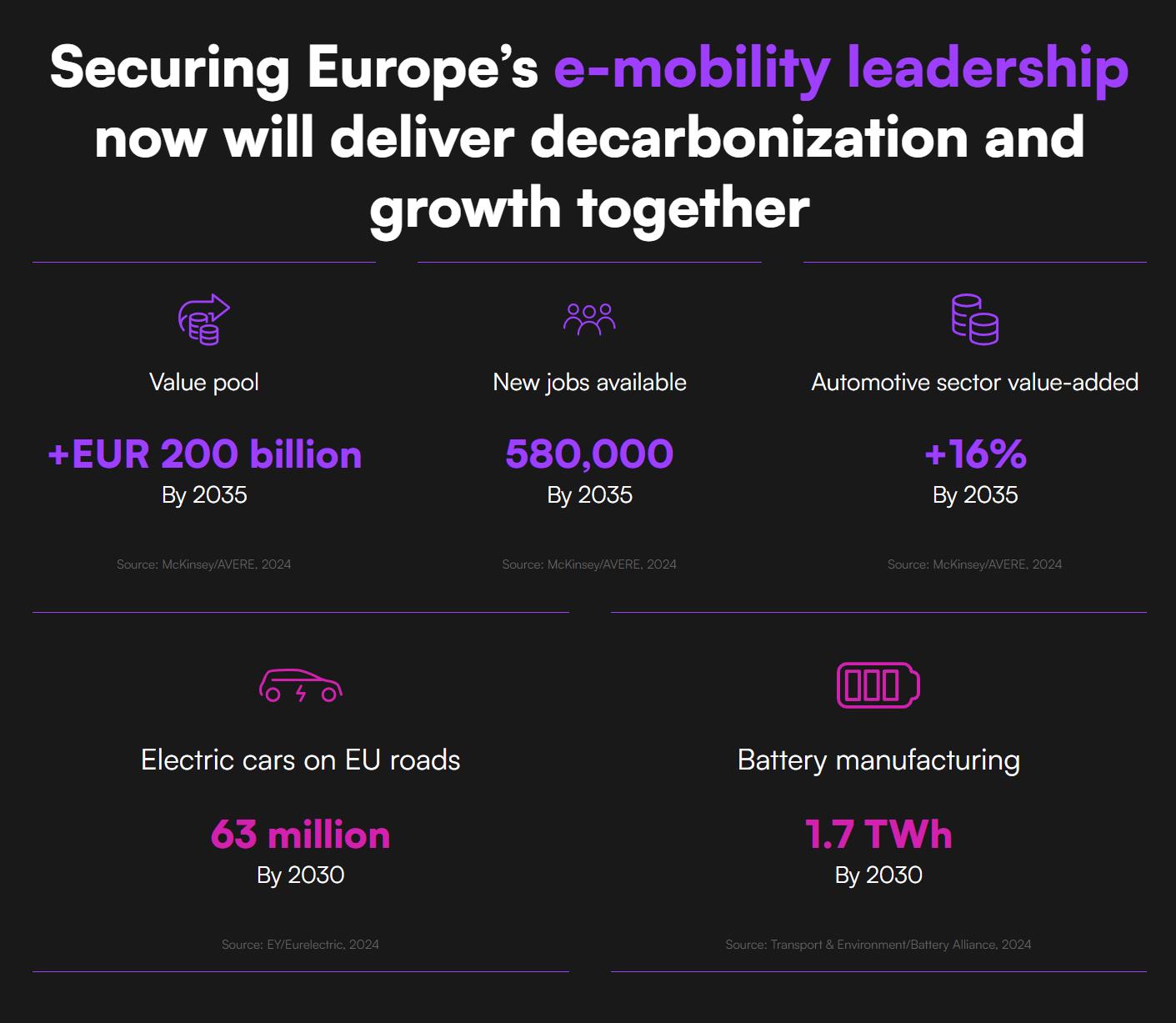

By 2035, it is expected:

- an increase in the value of the electromobility market by more than EUR 200 billion

- creation of 580,000 new jobs

- an increase in the value of the automotive sector by 16%

By 2030, it is expected:

- 63 million electric cars on European roads

- production of batteries with a volume of 1.7 TWh

The transition to electromobility requires a strong political foundation. The European Union should:

- Maintain ecological ambitions directed towards 2035 and support market transformation.

- Deliver the industrial policy Europe needs to compete.

- Strengthen energy networks.

- To support skills, competences in the field of research and development and digital connectivity.

- Expand market incentives.

Source: www.nextech.sk