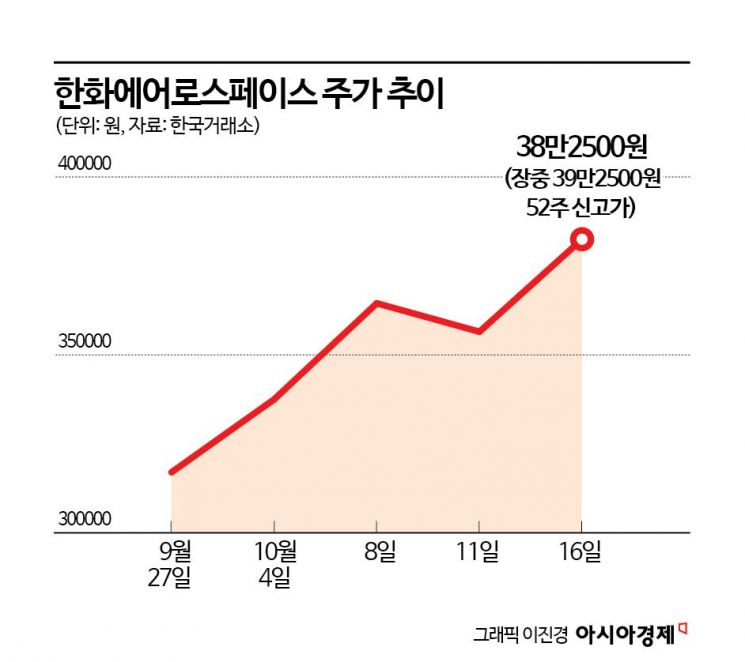

After the spin-off, trading resumed on the 27th of last month.

Increased by more than 30% after trading resumed

It rose to 392,500 won during the day on the 16th, hitting a 52-week high.

We are raising our expectations due to good performance prospects.

The division of personnel was completed.

Hanwha Aerospace

Hanwha Aerospace

012450

|

KOSPI

Securities information

Current price

382,500

Compared to the previous day

8,500

fluctuation rate

+2.27%

trading volume

466,193

Jeonilga

374,000

As of 2024.10.16 15:30

Related articles

LS Mtron cooperates with Hanwha Aero to develop ‘fully unmanned autonomous work tractor’ Hanwha Aero, automated self-propelled artillery ‘K9A2’ lands in US market (Click e-stock) “Hanwha Aerospace continues good performance… investment opinion/target price up”

close

The stock price continues to soar. The recent influx of foreign buyers amid the strong performance of defense stocks and good performance prospects are considered factors in the stock price rise.

View original icon

According to the Korea Exchange on the 17th, Hanwha Aerospace rose to 392,500 won during the day, hitting a 52-week high. It closed at 382,500 won, up 2.27% from the previous day, and is on the verge of exceeding 400,000 won.

Hanwha Aerospace, which resumed trading on the 27th of last month after completing its spin-off, has seen its stock price rise by more than 30% since trading resumed. The stock price, which was 290,000 won before trading resumed, rose to around 380,000 won.

Hanwha Aerospace’s stock price also rose as defense stocks showed strength due to recent geopolitical risks in the Middle East and heightened military tensions between North and South Korea. In particular, foreign buying drove the stock price rise. Foreigners made a net purchase of 295 billion won in Hanwha Aerospace from the 27th of last month, when Hanwha Aerospace trading resumed, to the previous day, making the second largest purchase after SK Hynix.

The outlook for performance is also positive. Lee Ji-ho, a researcher at Meritz Securities, said, “Hanwha Aerospace’s performance in the third quarter of this year is estimated to be KRW 2.56 trillion in sales, a 29.2% increase from the same period last year, and KRW 350 billion in operating profit, a 205.1% increase. “The operating profit will exceed the consensus (average forecasts of securities companies) by 5.2%,” he said. “The current consensus includes some of the pre-split performance forecasts, so it is considered to be a big surprise in reality.”

Reflecting the favorable performance outlook, securities firms have recently raised Hanwha Aerospace’s target stock price. Hana Securities raised its price from 375,000 won to 440,000 won, and Meritz Securities raised its price from 360,000 won to 460,000 won. KB Securities raised its price by 30.8% to 425,000 won.

The recently announced new facility investment plan is also evaluated as positive for mid- to long-term growth. Previously, Hanwha Aerospace announced new facility investment in propellant production facilities worth 667.3 billion won on the 25th of last month. Researcher Lee said, “As there is currently little need for expansion of artillery production capacity in Korea, this expansion is expected to respond to external demand,” adding, “Europe currently has an ammunition production capacity that is one-fourth of that of Russia, leading to an ammunition shortage.” It is expected that Hanwha Aerospace will gradually expand its presence through this expansion, as it already has a track record of receiving orders from British defense companies. “It was analyzed. He added, “The energizer export business, which generates steady sales, can be expected to have effects beyond main cost orders and can be considered a mid- to long-term growth engine, so it is judged to be a positive investment.” Wi Gyeong-jae, a researcher at Hana Securities, said, “We need to pay attention to the possibility that ammunition may sharpen the slope of performance improvement,” adding, “Even though ammunition sales were not reflected in the second quarter, good performance was recorded, and on an annual basis, the proportion of ammunition sales was in the upper 10% range. “Given that this level of investment is possible, we believe that this decision to invest in facilities can serve as a cornerstone for future increases in ammunition sales,” he said.

There are predictions that it will not be long before the company joins the 20 trillion won market capitalization club. The researcher said, “We are on the verge of joining the 20 trillion won club,” and added, “Even after taking into account deficits due to Satrec I and consolidation adjustments, the investment appeal is still high in that it is possible to derive a corporate value of 20 trillion won.”

Reporter Song Hwa-jeong pancake@asiae.co.kr

<ⓒ투자가를 위한 경제콘텐츠 플랫폼, 아시아경제(www.asiae.co.kr) 무단전재 배포금지>

Source: www.asiae.co.kr