The five largest listed securities companies have an operating profit of 5 trillion won… Hantoo, Samsung, Mirae, and Kiwoom 4 companies ‘1 trillion’

‘Commissions 4 times’ Overseas stock trading offsets domestic slump… Relieve the burden of PF provisions

The five largest securities companies are expected to overcome the sluggish domestic stock market environment and return to the ‘KRW 1 trillion club’ in operating profit. While the burden of paying provisions related to real estate project financing (PF) risks, which had weighed down the securities industry, has eased, foreign stock commissions have increased, and most large securities companies are expected to achieve a ‘V-shaped rebound in performance’.

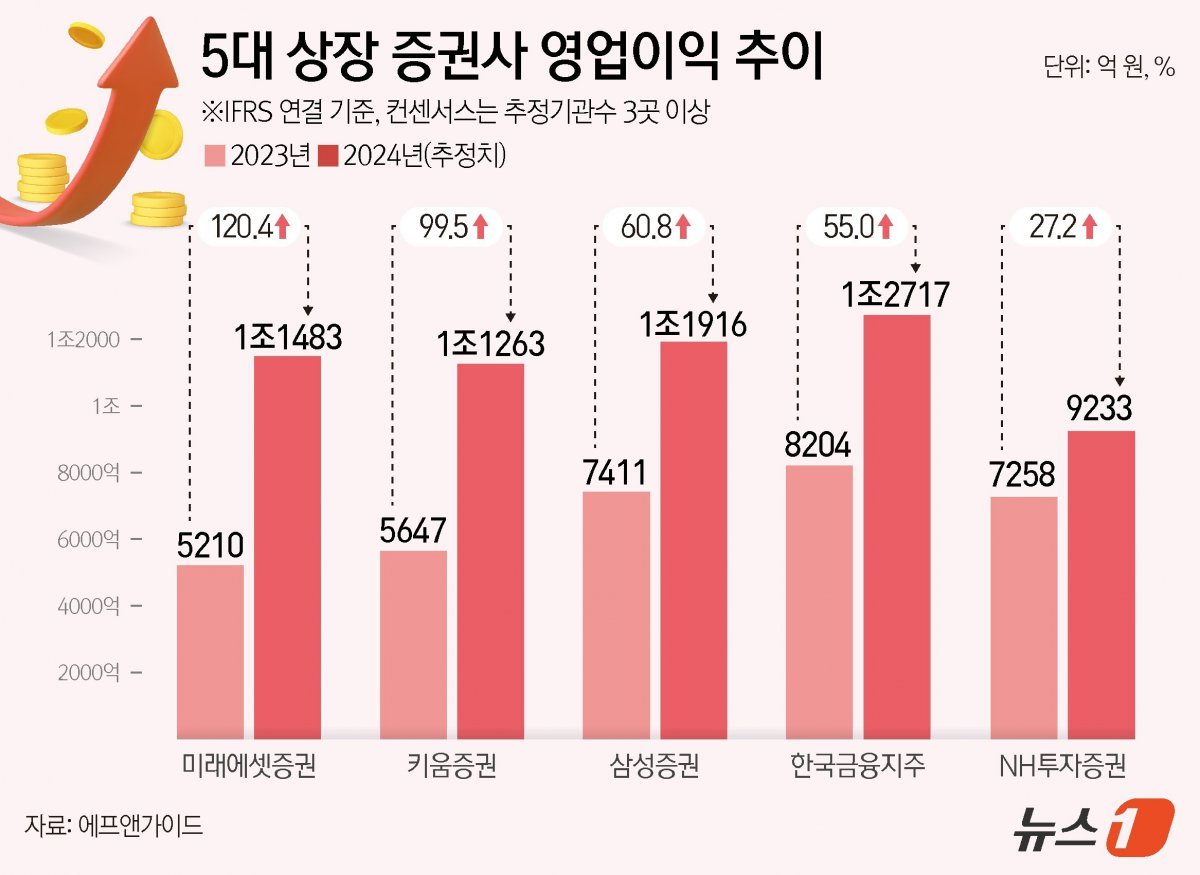

According to the 2024 performance consensus (average forecast of securities companies) by financial information company FnGuide on the 13th, the operating profit of the five major listed securities companies (Korea Financial Group, Samsung Securities, Mirae Asset Securities, Kiwoom Securities, and NH Investment & Securities) last year was KRW 5.6611 trillion. It is estimated to increase by 67.8% compared to the previous year (KRW 3.373 trillion).

Four out of five companies are expected to exceed 1 trillion won in operating profit. Korea Investment Holdings, which owns 100% of Korea Investment & Securities, is expected to have the highest operating profit of 1.2717 trillion won. Samsung Securities (KRW 1.1916 trillion), Mirae Asset Securities (KRW 1.1483 trillion), and Kiwoom Securities (KRW 1.1263 trillion) are expected to follow. NH Investment & Securities is also expected to record an operating profit of 923.3 billion won.

In terms of growth rate, Mirae Asset Securities is expected to show the largest increase at 120.4%. Kiwoom Securities is also expected to see its operating profit increase by 99.5%, nearly doubling its growth. After that, the operating profit growth rate is expected to be higher in that order: Samsung Securities (60.8%), Korea Financial Group (55.0%), and NH Investment & Securities (27.2%).

It is the first time in three years that domestic listed securities companies have returned to the 1 trillion won club. During the 2021 coronavirus pandemic, the ‘Big 5’ securities companies, including Mirae Asset, NH, Samsung, Korea Investment, and Kiwoom Securities, entered the 1 trillion won club due to the unprecedented ‘Donghak Ant’ craze. However, the following year, they were all pushed back due to concerns about worsening profitability due to the global interest rate hike and sluggish stock market, and PF insolvency. Only Meritz Securities, an unlisted company, achieved an operating profit of 1 trillion won the year before last.

The main players who led the performance recovery last year were Seohak Ants (investors who invest in overseas stocks). Last year, the average daily trading value of the domestic stock market was 19.1 trillion won, a decrease of about 2% compared to the previous year. However, overseas stock trading volume increased by about 84% from $288 billion to $530.8 billion, offsetting the impact of the sluggish domestic stock market. Usually, the commission rate for foreign stocks is about four times higher than that for domestic stocks.

The fact that real estate PF provisions and the burden of damage to overseas investment assets were eased also contributed to performance improvement. According to KB Securities, in 2023, five large companies reflected KRW 389.3 billion in PF-related provisions and KRW 831.7 billion in damage to investment assets such as overseas real estate.

Stock market experts judged that the upward trend in securities firms’ performance would continue this year. This is because the internal and external environment is expected to improve, and the number of businesses that will become new sources of food for large companies is expected to increase.

Jeon Bae-seung, a researcher at LS Securities, said, “The industry recovery will continue due to increased liquidity due to additional interest rate cuts this year and reduced risks related to domestic and foreign investment assets, including real estate PF,” and added, “If the returns on asset classes that were sluggish last year, such as the domestic stock market, improve, this phenomenon will increase.” “It will accelerate further,” he predicted.

Kang Seung-geon, a researcher at KB Securities, said, “There is growth momentum in 2025 with the expansion of securities companies’ reception base, including bills issued and comprehensive investment accounts (IMA), and corporate finance and trading profits.” He added, “Trading volume is expected to increase after the launch of alternative exchanges. “Fee income and stock market recovery are also expected points,” he explained.

(Seoul = News 1)

Source: www.donga.com