In its latest report, “The State of Ecommerce in 2024: Digital Trends and Strategies for Success,” Similarweb unveils the latest trends in mobile websites and app traffic in the retail sector. The analysis explores the growing importance of mobile-first strategies in the retail and fashion sectors, highlighting the central role of mobile apps in the face of declining web traffic.

Mobile applications continue to gain ground. The report ” The State of E-Commerce in 2024: Digital Trends and Strategies for Success » Similarweb reports significant growth in app usage across markets, driven by low-cost giants such as Temu, Action, Lidl or even AliExpress. According to the report, Mobile apps provide businesses with valuable information about their customers, improving targeted marketing strategiesThe analysis also highlights the need for major retailers to focus on app development to compete with direct-to-consumer brands, offering personalized experiences to acquire and retain customers.

Mobile-first: Leveraging app growth as web traffic declines

Web Traffic and App Sessions – Year-Over-Year Change – Top 10 Marketplace Websites and Apps Website Viewed on Mobile, Desktop, and Android, May 2022 – April 2024 vs. May 2023 – April 2024

Although web traffic on major marketplaces in the UK and Germany declined year-on-year, app usage increased. In France, the use of applications for the main marketplaces has increased four times faster than traffic on websites. This trend highlights a significant opportunity for businesses to prioritize expanding their app user bases. By leveraging apps, businesses can better understand customer behavior and implement more effective targeted marketing strategies.

While Temu’s launch in Europe and the UK in April 2023 had a huge impact across all markets, the substantial growth in app usage in France was also driven by other brands. Discounter Action, one of the largest marketplaces in the country, launched its app in October 2022 and has seen continued growth since thenThe app recorded over 600,000 sessions within a month of its launch and reached 1.02 million sessions by April 2024. Other low-cost marketplaces also saw notable growth in app usage year-over-year, including Decathlon (+32 %) et LightInTheBox (+26 %).

Consumer loyalty to low-cost marketplaces appears to be growing in other markets as wellas shoppers experience personalized shopping experiences through their apps. In the US, Costco’s app sessions increased by 18%. In the UK, AliExpress saw a 7% increase in app sessions, while in Germany, Lidl and AliExpress saw growth of 21% and 14%, respectively.

App Development: The Key to Retention in an Increasingly Fragmented Market

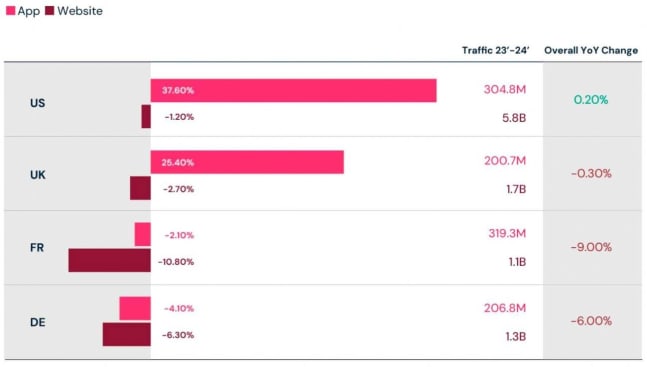

Web Traffic and App Sessions – Year-over-Year Change – Top 10 Fashion Websites and Apps Website Viewed on Mobile, Desktop and Android, May 2022 – April 2024 vs May 2023 – April 2024

Just like in the marketplace industry, The use of apps is increasingly becoming the main mode of interaction between customers and fashion brands. Despite a decline in visits to major fashion websites in the US and UK, app usage increased by 38% and 25% respectively, offsetting this overall decline. Conversely, app usage declined in France and Germany, in line with the decline in web traffic, although app usage declined at a slower pace. Overall, across these four markets, consumer appetite for apps is helping to offset the impact of the faster decline in website visits for fashion brands.

Cheap retailers are the main drivers of app usage growth in all countries. Shein stands out as one of the fastest growing fashion apps among the major players in all four markets, with growth rates of 63% in the US and 49% in the UK. In the UK, Vinted is also playing a major role in driving app usage, with app sessions increasing by 72%. In addition, other budget retailers are contributing to this growth, including Sports Direct in the UK, Kiabi in France and C&A in Germany.

The Fashion and Apparel sector is facing stagnant global growth as consumers increasingly gravitate towards direct-to-consumer brands that prioritize a seamless shopping experience. To be competitive, major retailers must prioritize app development. Mobile apps allow them to collect valuable customer data, allowing them to personalize experiences and target consumers more effectively, ultimately driving customer acquisition and retention.

To learn more, the full Similarweb report is available at the following link.

Similarweb’s methodology is available at the following link.

Source: www.ecommercemag.fr