Havas Commerce and CSA Data Consulting in partnership with Paris Retail Week surveyed 1,000 French people (aged 18 and over, representative of the French population) in June 2024 via an online questionnaire. Here is the summary note written on the study by their authors.

Since March 2020, the world has experienced major upheavals. These events have plunged the global trade economy into a period of unprecedented uncertainty. Faced with these multiple crises, new consumer behaviors are emerging, disrupting purchasing habits and forcing retail players to adapt. This study is part of this context and aims to analyze the feelings and expectations of French consumers, in order to understand the evolution of their distribution channel choices and their aspirations for the future.

A changing world: New constraints and new opportunities

French consumers are facing unprecedented challenges: declining purchasing power, supply disruptions, growing environmental concerns, etc. In this changing context, new trends are emerging. By analyzing the feelings and expectations of French consumers, this study aims to provide valuable insights into the transformations underway in the world of commerce. It will also provide a better understanding of how players in the sector are adapting to these changes and how they envision the future.

Confidence down, annoyanceent on the rise: purchasing powert at its lowest

In the qualifiers that sum up the state of mind of the French, fear continues to progress.

The economic and political situation weighs heavily on the morale of the French: 85% of them have a negative perception of the current climate (compared to 88% in 2023). This gloom translates into a loss of purchasing power felt by 88% of the French (compared to 92% in June 2023). Inflation (92%), stagnant wages (45%) and an increase in compulsory deductions (44%) are the main causes of this deterioration. As a direct consequence, the French are gradually getting used to the crisis and finding solutions to inflation, with 76% of them juggling tight family budgets (compared to 81% in June 2023). Even if consumers remain mostly negative, 14% of the French are trying to see the context in a rather positive way.

Generalized price increase and impact on the daily lives of the French

However, inflation is felt in all areas. The increase in energy prices (84%) and food prices (80%) is hitting households hard. Faced with this situation, the French are postponing investment projects (82%), savings (64%), vacations (55%), outings (55%), personal pleasures (54%), gifts for loved ones (54%), and even reducing their food expenses (33%).

Physical stores vs. e-commerce: an unchanged preference

Despite the rise of e-commerce, the French remain loyal to purchases in physical stores (84%) compared to 16% online. Favoring stores allows you to touch and try the products (62%), leave immediately with your purchases (49%) and feel more confident (47%).

New purchasing habits and fight against waste and the rise of digital technology

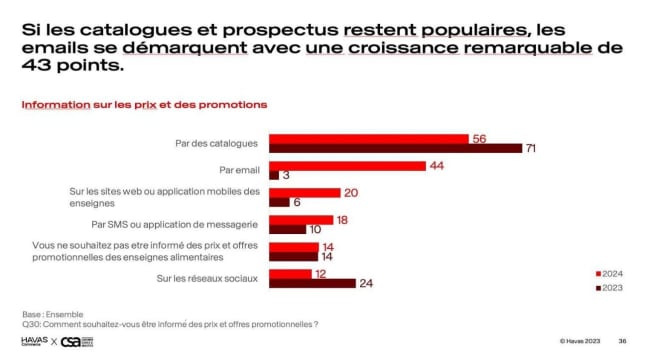

If the fight against food waste tends to weaken (44% against 49% in June 2023), the purchase of second-hand products is gaining ground (33% against 32% in June 2023). The French are also increasingly adopting digital tools: virtual clothing try-ons (21% versus 17% in June 2023) and drive-through (20% versus 20% in June 2023). Checking emails for promotions is booming (44% versus 3% in June 2023).

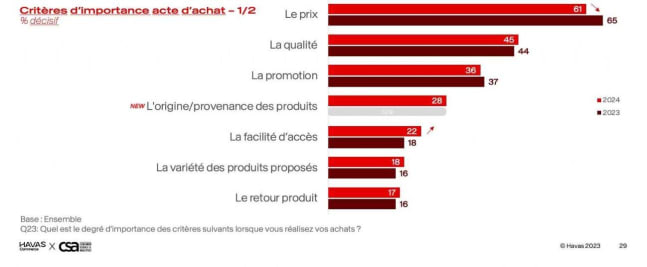

Prices still at the heart of concerns and increasing attention to the origin of products

We see a little less pressure on prices and promotion, a little more quality and variety.

Price remains the main purchasing criterion for 61% of French people (compared to 65% in June 2023), ahead of quality (45%) and promotions (36%). The origin/provenance of products becomes an important criterion for 28% of French people. 36% of French people make purchases online, with price as a determining factor.

Diversification of the brands frequented and Discounters in full swing

Supermarkets (56%) and hypermarkets (48%) are losing ground to rapidly expanding discounters (26%). Leclerc remains the most popular and most appreciated food brand, followed by Coopérative U: 2 visions of commerce favored by the French: price and the local cooperative model. Amazon and Action dominate non-food.

Information and promotions: strong consumer expectations

The French want to be informed about prices and promotional offers via the websites/apps of the brands (20%), SMS (18%), social networks (12%), catalogs (56%) and leaflets (41%). 14% of the French do not want to receive any promotional information.

Brand commitment: Price, French production and responsibility

The main expectations of the French towards brands are: a commitment on prices (priority no. 1), support for French farmers (33%), the promotion of French products (30%), a more local and more environmentally friendly offer (23%) and actions to engage and rethink the relationships between farmers, manufacturers, traders and consumers (21%).

Food sovereignty and investment priorities

The loss of food sovereignty is a concern for 87% of French people. Faced with globalization, more than 8 out of 10 French people want to limit their dependence on external sources of supply. Food imports (38%), climate change (36%) and political crises and conflicts (35%) are identified as major obstacles to food sovereignty. Public health, education and SMEs are popular with the French as priority areas of investment for a better future. The political agenda of the French: more health, more education, more ETIs and SMEs and finally returning to the country’s historical DNA.

Skepticism about the ability of brands to become more responsible

Despite their expectations, the French are skeptical about the ability of brands to become more responsible, greener and more sustainable. Organic brands, artisans and independent businesses are perceived as more likely to make efforts in terms of the environment than supermarkets, hard discounters and hypermarkets. The fight against food waste (45%) remains the priority for the French in terms of ecology and the environment, ahead of water pollution (31%) and air pollution (31%).

Skepticism about retailers’ commitment to purchasing power and expectations regarding customer relations

68% of French people doubt the real commitment of brands to support purchasing power. The quality of the response remains the number 1 expectation of consumers (52%) in terms of customer relations, and this for all age groups.

French consumers still attach importance to “made in France” and CSRin addition to an attractive price. However, it should be noted that their overall expectations are lower than in 2023.

While French production remains globally essential, the 18-24 age group stands out by placing increased importance on “efficient, fast and smooth customer service”, followed by “adherence to CSR criteria”. For 43% of French people, respect for the customer remains an important element. However, there is an overall downward trend, suggesting that the French have lower expectations after a difficult year. More than ever, people are at the heart of the French people’s concerns. An increase of 2 points (74%) underlines the importance of maintaining customer service as an area of human interaction.

AI: The Future of Commerce?

93% of French people have heard of AI and only 18% have used it for a produced search (which is already huge). While the idea of AI-based customer service is struggling to appeal to the French as a whole, it represents a promising opportunity for 18 to 34 year olds.

We have entered a period where inflation has become the norm.

This does not mean that the French are satisfied with their fate and the state of the country. Annoyance and fear remain very high in the fears of our compatriots. As the answers progress compared to the questions asked at the same time last year, the French seem “a little less focused” on a search for low prices and alternative consumption strategies but are gradually returning to consumption processes prior to the inflationary crisis. E-commerce consumption is growing again. Over time, the French have an increasingly clear vision of the economic program that would allow the country to recover and improve things. In the toolkit of solutions, food and industrial sovereignty are in good place. The health and education sectors of ETIs, SMEs and SMIs are among the priority areas for recovering the country. Finally, in 4th position, the French place the country’s historical strengths as an axis for the country’s redeployment: we can imagine luxury, nuclear power, agriculture, gastronomy, health, tourism… all these sectors have contributed to the country’s development so far.

Source: www.ecommercemag.fr