The Amazon answer to the discount, low-cost business model of Temu and Shein. The Amazon Haul store is available exclusively via mobile app or mobile web browser and offers similar mass-produced, low-cost products, most of which come from China. This is a departure from Amazon’s long-standing business model, which has so far campaigned on fast delivery times, because even Amazon cannot reduce the time it takes to procure goods from overseas.

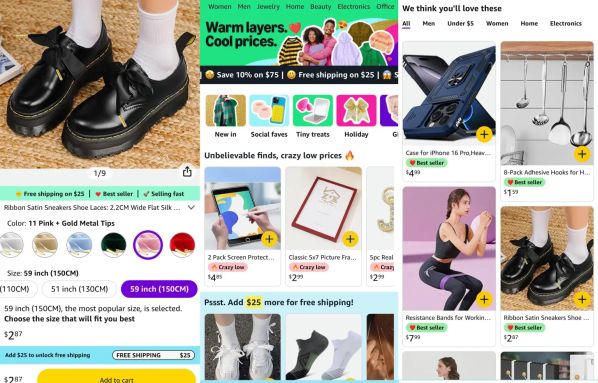

The Amazon Haul its home page is already reminiscent of Shein and Temu’s stores in its design: the items are displayed in grids instead of the typical Amazon list, and delivery times and star ratings are only visible when you click on an item. Some products have rocket emojis to warn you that this $4.99 iPhone 16 Pro case is “selling fast”! Or the fire emoji shows that a three-pack of $2.89 mesh laundry bags is “crazy low”! Amazon Haul, like its competitors, also sells clothing ($16 for men’s golf pants or $4.99 for women’s 80s leg warmers).

“While Amazon continues to offer more than 300 million products with fast, free shipping for Prime members, we also hear from customers that sometimes they’d like to buy ultra-low-priced items, even if some take a week or two, by the time it arrives,” writes Amazon in the announcement. Amazon hopes that Haul’s user base will be clearly separate from the original e-commerce service, and at the same time more potential reach customers through mobile devices.

All products are imported by Amazon and sold through its platform, rather than being shipped directly from merchants in China and other regions. Goods ordered through the service are delivered to customers within 2 weeks at the earliest, and regardless of whether the customer subscribes to Amazon Prime, each order must be over $25 to receive free shipping, otherwise 3.99 $ shipping fee applies.

Temu and Shein have received widespread criticism for their environmental impact as a byproduct of their worldwide shipping and the waste generated by fast fashion. A consumer protection investigation has been launched against both companies in the European Union, where regulatory authorities are investigating whether they may be using addictive algorithms and selling unauthorized products.

Despite the controversy surrounding them, these budget retailers are still incredibly popular with Gen Z. The most popular app among US users aged 18 to 24 was Temu, with nearly 42 million downloads in this demographic between January and October 2024, according to research by app information firm Appfigures. For Shein, this estimate is around 14.7 million downloads, although it’s possible that the difference in download numbers is so large because young people have already downloaded Shein, which has been around longer than Temu.

A big risk for Shein and Temu is that consumers may not be buying from unknown sellers, which could potentially be misleading; consumers trust Amazon, but the company works with similar mass-market sellers, largely based in China. But Amazon says it pre-screens sellers, and if customers want to return their purchases, they can do so for free within 15 days, as long as the product’s value is over $3.

The timing for Amazon to launch this business model is questionable, given that President-elect Donald Trump would impose a 60% tax on imported Chinese goods. However, this tariff proposal is not written in stone – it is common for politicians to modify their campaign program after winning. However, the popularity of Chinese e-commerce shipments has attracted bipartisan attention. The Biden administration has already proposed to Congress that it take steps to crack down on “significantly increased abuse” of the “de minimis” exception by Chinese e-commerce companies. The de minimis exemption allows shipments worth less than $800 to enter the U.S. duty-free, helping retailers like Temu and Shein maintain low margins.

Source: sg.hu