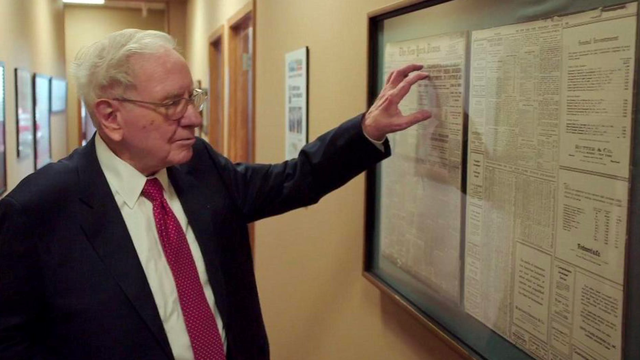

Warren Buffett has taken “unconventional” approaches to some potential stocks.

Many people still mistakenly believe that Warren Buffett has been successful since he was a young investor by researching a long list of stocks and choosing the cheapest ones. However, in reality, he had to make a lot of effort to know how he was buying shares of a business before making a decision.

Author Brett Gardner of “Buffett’s Early Investments: A new investigation into the decades when Warren Buffett earned his best returns” ) shared in this book. Gardner pointed out that the billionaire persistently tracked information from businesses.

When he was young, Buffett skipped school to attend shareholder meetings or paid people to ask him questions. He also travels across the United States to meet with CEOs of businesses, examining their financial situations, personal habits and motivations.

In a 2010 interview, Buffett biographer Alice Schroeder also mentioned Buffett’s strategy as a young man. She said: “He acted like an investigative journalist. He read the Moody’s stock-picking manual, but he didn’t stop there.”

Here’s Buffett’s approach to stocks:

Before investing in Disney in 1996, Buffett visited Walt Disney, who took him on a tour of Disneyland and told him about the company’s plans. Buffett also went to see Disney’s latest blockbuster at a New York theater to gauge the company’s longer-term value. “I was there with a briefcase at 2 p.m., going to see Mary Poppins,” Buffett said.

Back in 1964, before he put his money into American Express, Buffett assessed whether the company’s salad oil scandal would affect the brand. Schroeder wrote in “The Snowball: Warren Buffett and the Business of Life” that Buffett went to restaurants in Omaha and looked for places that accepted Amex cards and Traveler’s Checks from the company.

He also asked a broker to dig deeper into the business, which resulted in a wealth of information about Amex tellers, office workers, restaurants, hotels, and credit card holders. Buffett was pleased to learn that the payments company’s business was still thriving and that customers still trusted its products.

Buffett told Forbes that he “spent almost a month counting tank cars in a railroad yard in Kansas City” in 1965. He wanted to learn about Studebaker and gauge demand for STP, a gasoline additive that was carried in those cars and sold by one of Studebaker’s subsidiaries. He knew where Studebaker was sourcing its key ingredient for STP and how much it would take to make one can. Counting the cars showed that STP production was increasing, prompting him to buy the company’s stock.

Another time, as a recent college graduate, Buffett took the train from New York City to Washington on a Saturday morning in 1951. He arrived at Geico’s office, but the door was locked. Buffett pounded on the door to see only one person: Lorimer Davidson, the insurance company’s future CEO. Buffett questioned Davidson for four hours and then invested about two-thirds of his money in the stock. In 1996, Berkshire acquired Geico.

In the mid-1950s, Buffett sent a partner to search for National American Fire Insurance shares that many scattered farmers in Omaha held. “He traveled across the state in his red-and-white Chevrolet, showing up at courthouses and rural banks, asking who owned National American stock,” Schroeder wrote. He sat on the front porch, drank tea and ate cake with the farmer couples and gave them cash to buy their stock certificates.”

Buffett took a different tack when he sought stock in Union Street Railway in 1954. The company was looking to buy back its stock by running ads in the local newspaper. So Buffett ran his own advertising campaign, inviting shareholders to sell him their shares. He even got up at 4 a.m. on a weekend to drive to New Bedford, Massachusetts, to meet with the company’s “boss.”

Buffett is famous for his investment strategy based on fundamentals like cash flow and P/E ratio. However, the examples pointed out by Gardner also show that the billionaire is an adventurous person not only in the financial field and is both persistent and creative in finding information as well as finding stocks worth investing in private.