The editorial staff of NEXTECH magazine annually conducts a survey of sales of enterprise information systems (ERP) on the Slovak market for the past year. As part of the survey, local producers of economic information systems, sales representatives of foreign companies operating in Slovakia, and sellers and implementers of their products were approached.

17 companies participated in the survey for 2022. Due to internal policies, some Slovak branches of global companies, including a probable SAP market unit, could not provide us with data related to the Slovak market.

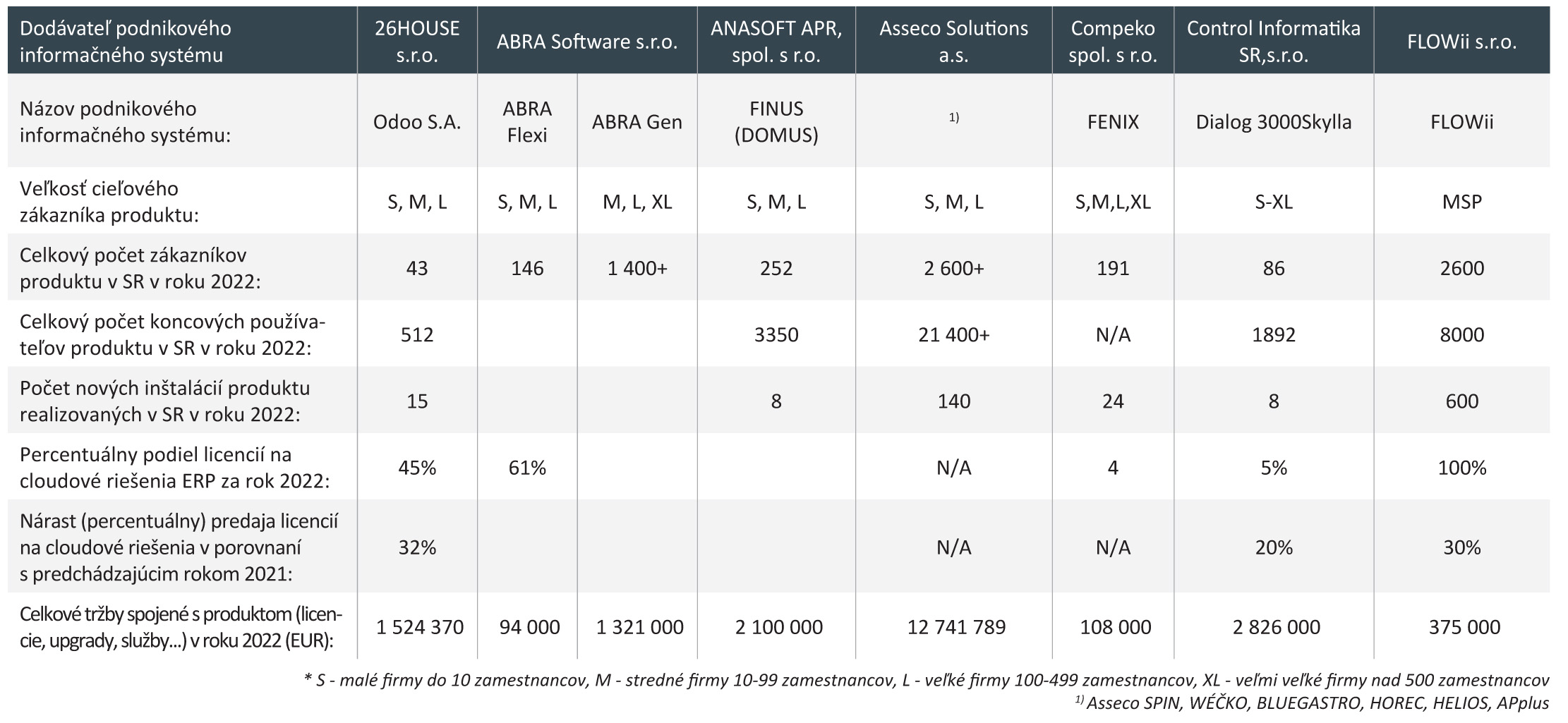

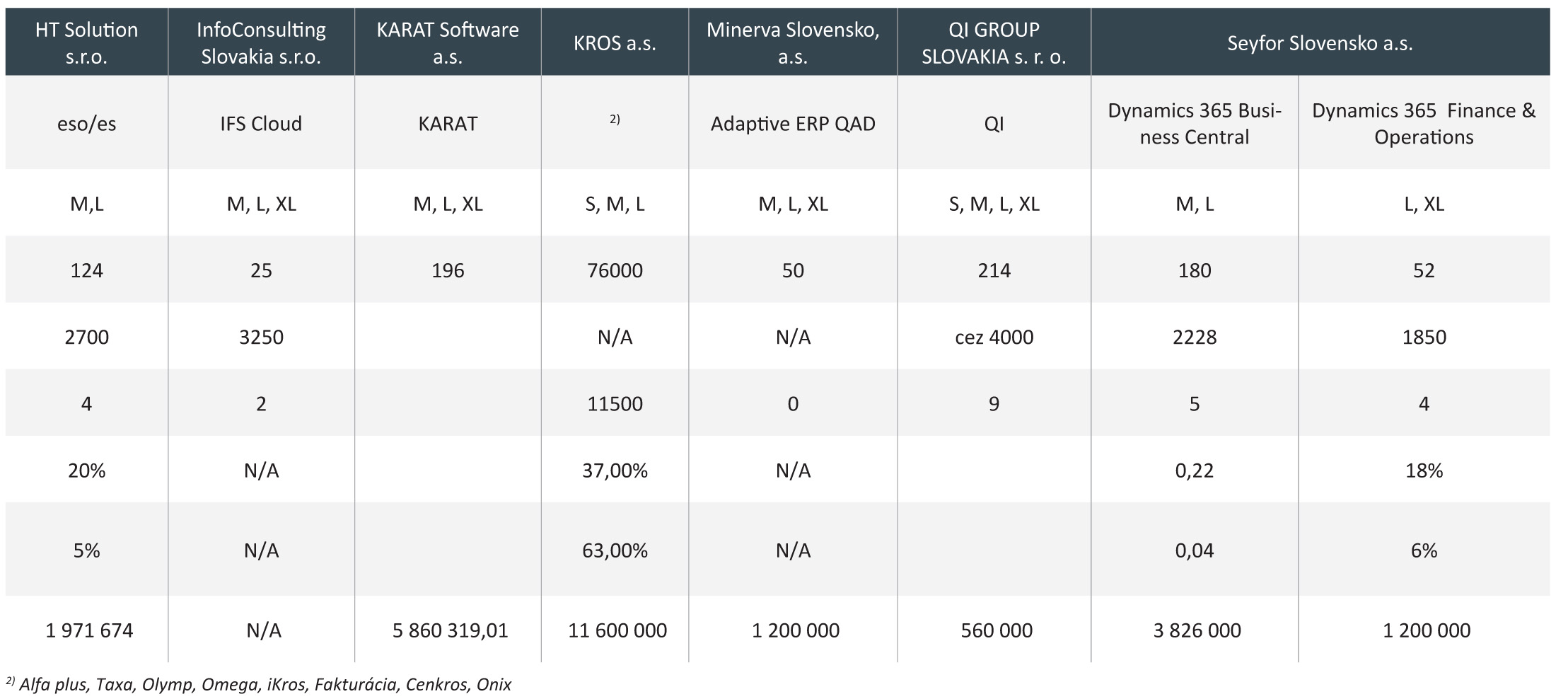

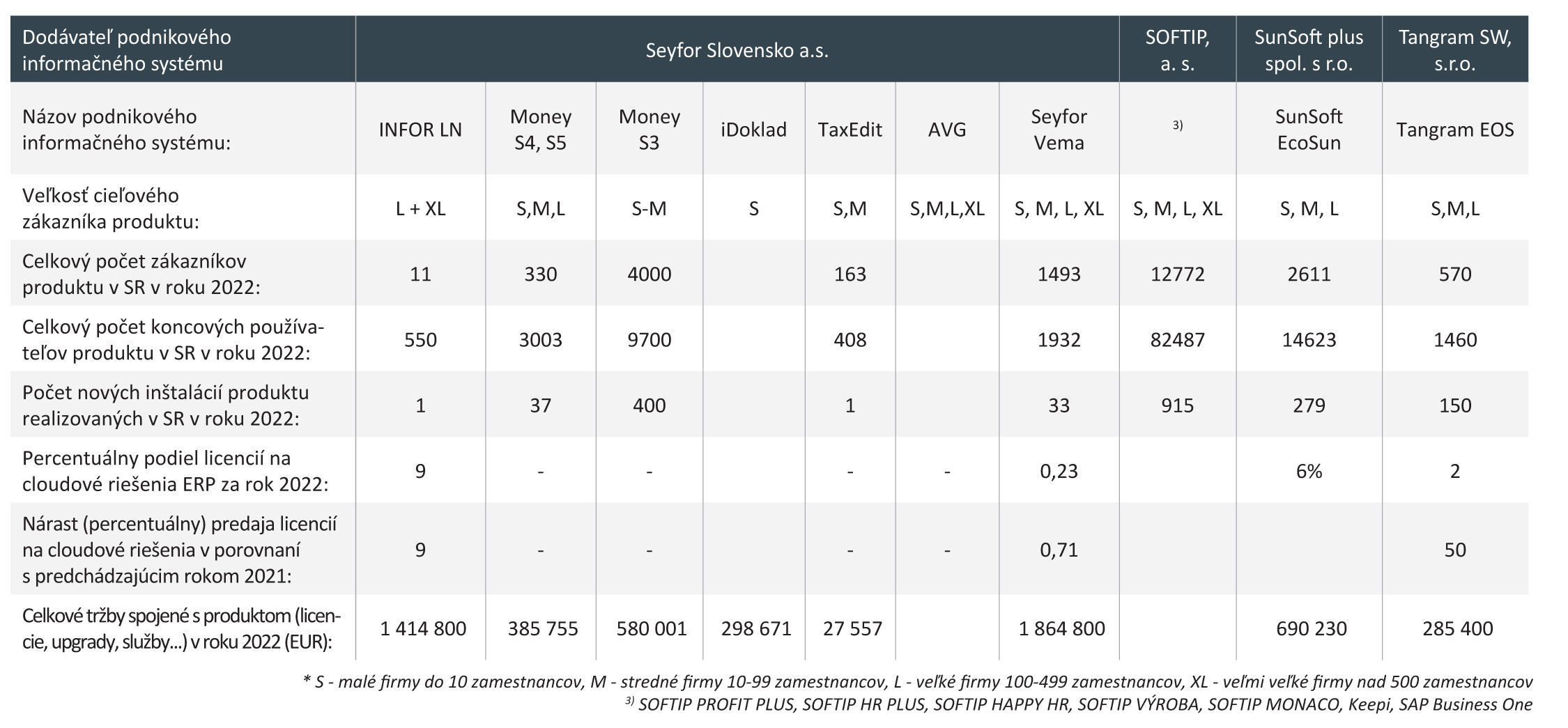

In the overview, we have included solutions for smaller customers, but also complex solutions for medium and large customers. The target group for which the respective product is intended can be estimated based on the total number of licenses, their ratio to sales, total sales or the number of customers. In the case of most suppliers, there is an obvious orientation to the selected market segment in terms of the “size” of the customer. Only a few companies provide ERP solutions for the segment of large enterprises and at the same time another product for smaller and medium-sized companies. We were also interested in the share of cloud solutions. The year 2022 was also partially affected by the global pandemic, but not as significantly as the two previous years. The companies managed to adapt to this situation, and in 2022 the pandemic had already died down.

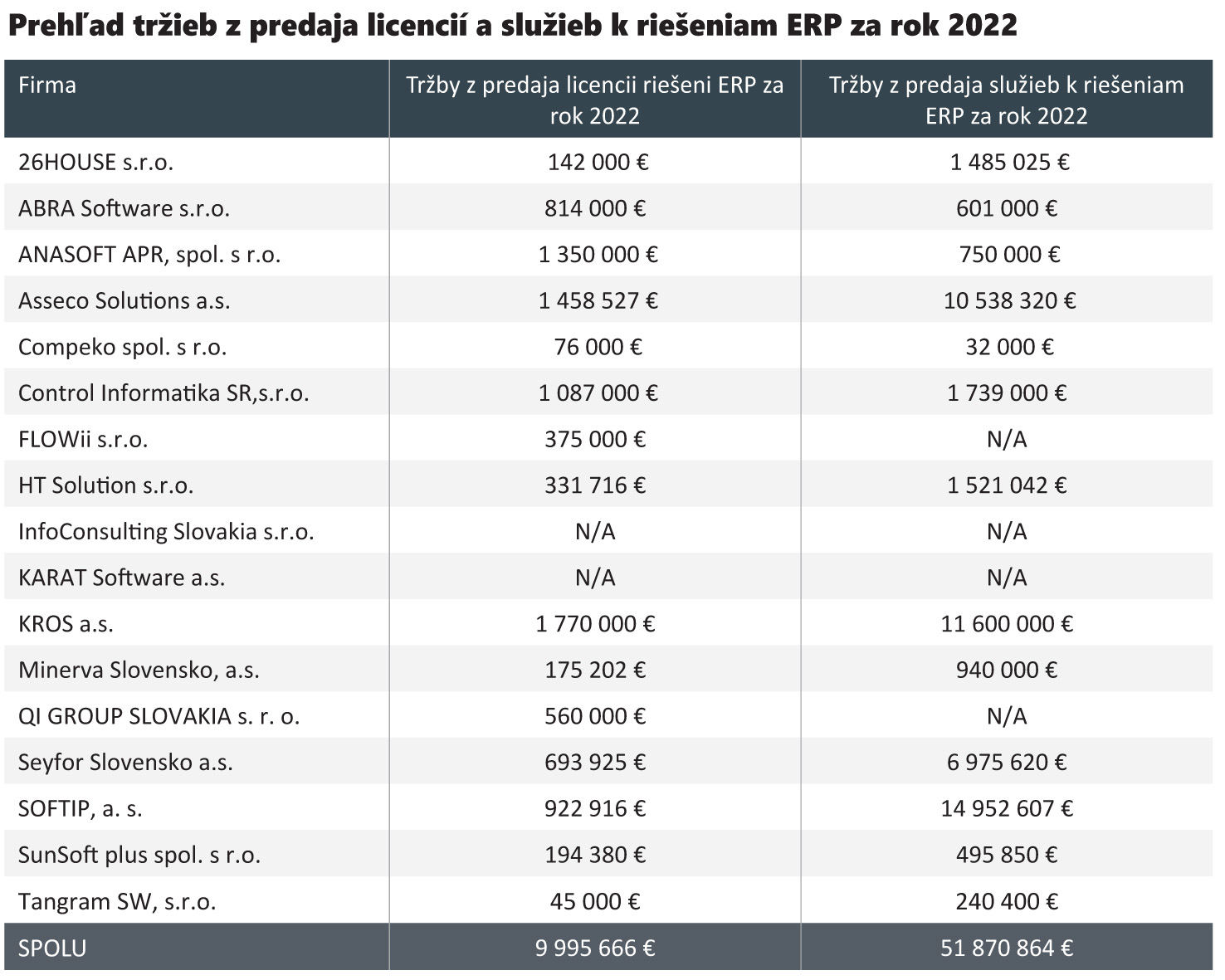

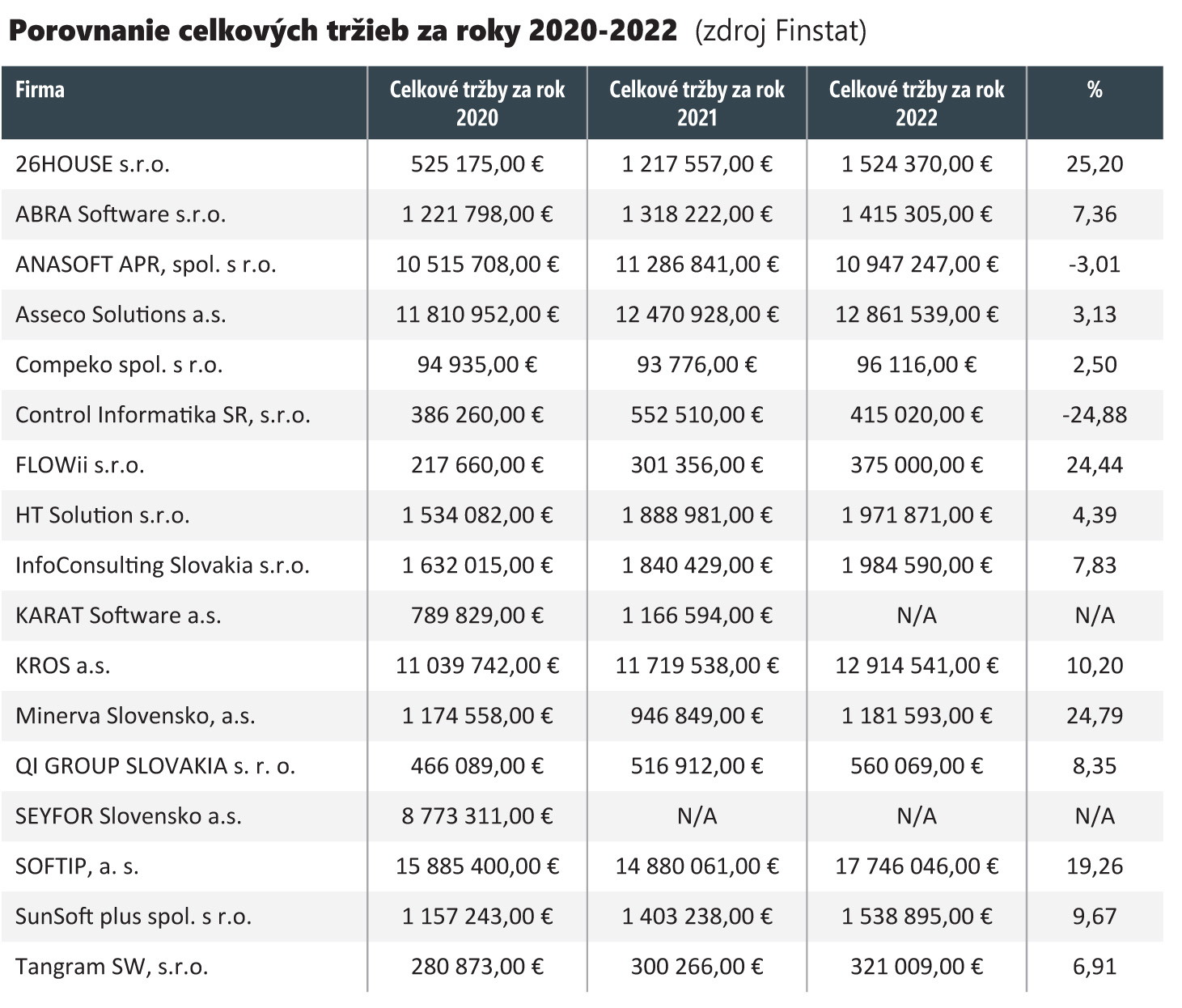

The total revenue from the sale of ERP solution licenses for the year 2022 was 9,995,666 euros, and the revenue from the sale of services for ERP solutions was 51,870,864 euros. Since some companies did not provide us with data in each of the categories and the same companies as last year did not participate in the survey, these data cannot be directly or percentageally compared. If we count the sales of the same companies that provided us with data for the years 2021 and 2022, sales in the area of license sales are stagnant, but in the area of service sales, sales have increased by almost 4.5 million euros. We remind you that these amounts do not include the sales of the local branch of SAP and other global companies.

If we divide the total revenue for ERP solutions of individual suppliers into revenue from the sale of licenses for the use of ERP solutions and revenue from the sale of services for these solutions, we find that the highest revenue from the sale of licenses was achieved by the company KROS as (1,770,000 euros), followed by Asseco Solutions ( 1,458,527 euros) and ANASOFT APR (1,350,000 euros). Information on license sales was not provided to us by InfoConsulting Slovakia and KARAT Software. For comparison, last year the order was Asseco Solutions, KROS and ANASOFT.

The company SOFTIP (14,952,607 euros) was ranked first in terms of revenue from the sale of services, the second place was KROS (11,600,000 euros) and the third place was Asseco Solutions (10,538,320 euros). Last year, the order was SOFTIP, Asseco Solutions and KROS. The companies FLOWii, InfoConsulting Slovakia, KARAT Software and QI GROUP SLOVAKIA did not provide us with data on sales of ERP services. We also included data on the percentage of licenses for cloud ERP solutions and its increase in the survey. The company FLOWii has, as last year, a 100% share of cloud solutions, ABRA software a 61% share, and the company 26HOUSE a 45% share. The biggest increase was recorded by KROS (67%) and Odoo SA (32%).

The flagship trend of recent years and the hit of 2023 is artificial intelligence. It will play a decisive role in the updated versions of ERP systems, especially with regard to the complex automation of business processes. If companies want to strengthen their competitiveness, they must invest in new solutions and, in cooperation with implementation partners, adapt these solutions to specific conditions.

Introductory photo: rawpixel.com on Freepik

Source: www.nextech.sk