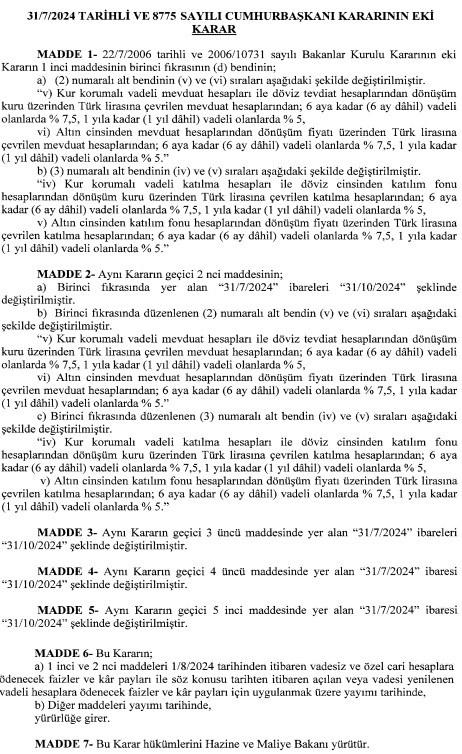

It was decided that a withholding tax of 5-7.5 percent would be applied to currency protected deposits.

The tax advantage applied to currency protected deposits (CCDs) has been removed; a withholding tax of 5-7.5% will be applied to these accounts.

The Presidency’s decision on the issue was published in the Official Gazette.

Accordingly, for currency protected time deposit accounts and foreign currency deposit accounts converted into Turkish lira at the conversion rate; 7.5% withholding tax will be applied for deposit accounts with a maturity of up to 6 months (including 6 months), 5% for deposit accounts with a maturity of up to 1 year (including 1 year); and for deposit accounts in gold converted into Turkish lira at the conversion price; 7.5% for deposit accounts with a maturity of up to 6 months (including 6 months), 5% for deposit accounts with a maturity of up to 1 year (including 1 year).

Source: bigpara.hurriyet.com.tr

.jpg?w=650&resize=650,365&ssl=1)