In 2025, the state estimates that it will need to cover the financing deficit of 31.86 billion euros. According to the forecast, the level of public funds needed to finance the various categories of public expenses is approximately 784.7 billion lei, respectively 156.94 billion euros. In order to finance this need for funds, based on the nominal increase in GDP in 2025 compared to 2024, the level of budget revenues for 2025 was estimated, which amounts to 625.1 billion lei, respectively 125.2 billion lei euros, resulting in a financing deficit of 159.3 billion lei, respectively 31.86 billion euros. With this level of budget revenues, the budget deficit target for 2025 of 7% of GDP could not be met as the estimated budget deficit level for 2025 would be over 8.2% of GDP. To cover this financing deficit, the funds that can be attracted to finance the budget deficit were taken into account in the amount of 133.3 billion lei, respectively 26.6 billion euros, the difference being covered by the additional revenues brought by the tax reform and for the administration of taxes and fees in the amount of 26.2 billion lei, respectively 5.24 billion euros (1.37% of GDP). Thus, the level of the budgetary impact of the tax reform in relation to the objectives pursued will be at least 1.1% of GDP for the year 2025, net of the impact of the increase in the non-taxable ceiling for pension income. In addition, from 2026, the positive budgetary impact of 0.5% of GDP is added as a result of the improvement in the collection of budgetary revenues, the Executive claims.

Reform 1: Fiscal reform

It is necessary for the fiscal-budgetary adjustment and concerns changes made to the system of taxes and fees according to benchmarks 207, 208 and 237, estimated to have a budgetary impact of at least 1.1% of GDP for the year 2025 net of the impact of the increase in the non-taxable ceiling for income from pensions, a reform that contributes to the fiscal adjustment significantly.

Reform 2: Reform of taxation of micro-enterprises

It is based on milestone 206 of the National Recovery and Resilience Plan (PNRR) and includes a series of changes that were mostly already ticked off, because they were the subject of payment request number 3. The estimated budget impact is 0.1% of GDP. It ensures measures to combat tax evasion, improve collection, reduce the GAP of taxes and fees as well as to modernize Romania’s fiscal system.

Reform 3: Reform of the administration of taxes and fees

It provides for the continuation of the digitalization program of the administration, the reduction of the GAP of taxes and fees, the improvement of the collection of taxes and fees and the updating of the legal framework specific to insolvency. Estimated budget impact 0.5% of GDP.

Reform 4: Reform of the expenditure system of state/local economic operators

It provides for the efficiency of the operational expenditure system, the improvement of the administration of public heritage and natural wealth, the introduction of expenditure norms, the monitoring of the public investment system, the reduction of dependence on the general consolidated budget. Estimated budget impact is 0.25% of GDP.

Reform 5: Restructuring of the public expenditure system

It foresees the introduction of spending norms, the systematic realization of thematic analyzes of public spending, the expansion of the centralized procurement system, the digitization of the public spending system. Estimated budget impact of 0.35% of GDP.

Read on Antena3.ro

The signs that are favored by the Universe in November. They are natives who drew the winning lot

Reform 6: Reform of the minimum wage

The entry into force of the act governing the new system of setting the minimum wage has already been achieved, with the government setting the introduction of the European minimum wage from the beginning of next year. The budgetary impact is an increase in spending by 0.11% of GDP.

Reform 7: Reform of the salary system in the public sector

Carrying out a global assessment of the impact of the Law on the remuneration of staff paid from public funds, including an assessment of the fiscal impact of the new law; the adoption and entry into force of the new legal framework regarding the remuneration of civil servants. The government estimates that this measure will reduce the share of personnel expenses by approximately 1% of GDP over the 2025-2031 forecast period.

Reform 8: Pension reform

Improving the legal framework to ensure the sustainability of Pillar II of pensions, increasing the contribution from 4.75% to 6% until 2031. The reform of the pension system based on the principle of contribution is also being considered. The budgetary impact of these measures will be -1.1% of GDP in 2025, -0.8% of GDP in 2026, and in total, throughout the entire period 2025-2031, a decrease in budget expenditures is forecasted by 1.8% of GDP.

Reform 9: Reform of special pensions

Here, the reduction of special pension expenses is foreseen. The budget impact for next year would be -0.02% of GDP, and in 2026 -0.03% of GDP, and by 2030 a reduction in expenses of up to 0.08% of GDP is estimated, compared to the projections in the pre-reform scenario. The reform prohibits the creation of new categories of special pensions and simplifies existing ones, reducing complexity and discrepancies in the system.

Reform 10: Reforming the business financing system

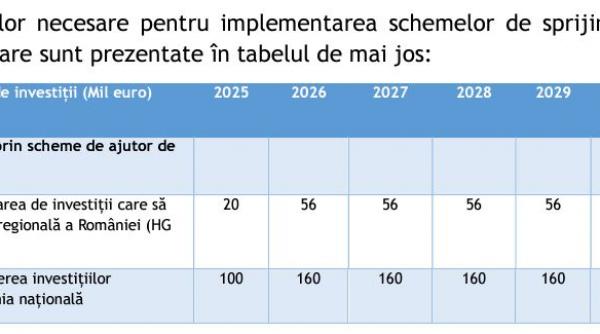

The government will focus on attracting investors, especially by attracting large investments in the economy. The establishment of the Investment Fund to support the business environment is being considered, as well as the regulation of credit for investments and grants allocated for the support of the manufacturing industry.

-

With regard to the agricultural sector, special emphasis will be placed on investments in irrigation infrastructure to combat climate change: it ensures the exploitation of Romania’s agricultural potential and, together with investments in the agri-food industry, it ensures the reduction of Romania’s trade balance deficit. Stimulating investments in this segment is estimated to reduce budget expenditures by 0.11% of GDP/year.

-

A second direction targets investments in the manufacturing industry, this being seen as the basis for Romania’s long-term economic development. In this case, the budget impact would be -0.12% of GDP/year.

The state’s financing costs are increasing

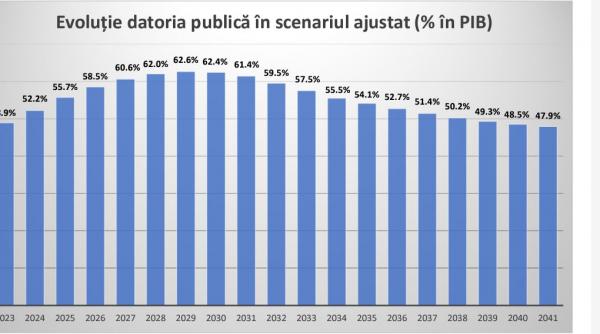

This reform necessary to reduce the budget deficit will also be accompanied by an increase in the financing costs of the state. The executive predicts that interest rates will rise, public debt will exceed 60% of GDP, and the exchange rate will deteriorate considerably by 2031.

The long-term interest rate, an indicator used to assess the government’s funding costs, is expected to rise to 6.9% in 2025 from 6.6% in 2024 and remain at this level until 2031. Also , we will witness in the period 2025-2031 an increase in Romania’s public debt by 10% of GDP, which will jump by 60% of GDP.

This year, Romania’s financing needs are estimated at 217 billion lei, a record level. “Interest expenses increase from a share of 2% of GDP in 2025 to a share of 3.5% of GDP in 2031, as a result of the increase in the share of public debt in GDP during the budget deficit adjustment period necessary to finance public investment projects”, the PFSTM states.

The Fiscal Code will change radically

In order to achieve the target of reducing the budget deficit, which the Executive is committed to achieving, it is considered to amend the Fiscal Code, so that the fiscal facilities granted to certain professional categories and the introduction of new taxes are eliminated, specifying that these measures are provided for in PNRR. Under these conditions, the new fiscal policy will focus on:

– the gradual elimination of tax incentives and tax loopholes in terms of income tax, profit tax (including special regimes that may be subject to exemptions);

– social contributions and property tax (namely local taxes);

– orientation of the fiscal regime towards the application of ecological taxes.

The list of changes includes the gradual reduction of the area of applicability of the special tax regime for micro-enterprises (which has already started), the gradual reduction of tax incentives for personnel employed in the construction sector (starts in 2025 and will be completed by the end of 2028), revision/adjustment of the system of personal deductions specific to income tax, expansion of ecological taxation, etc.

It will go to VAT and excise duties

What the business environment has been warning for a long time, namely that the Executive is considering the modification of the value added tax and excise duties, is now officially recognized through the PFSTM. The government says it is considering revising/updating the legal provisions in the field of value added tax and the excise duty system, but has not specifically shown what it wants to do. VAT is one of the main sources of tax revenue for the state, but Romania faces one of the highest rates of VAT fraud in the European Union, a fact that affects not only revenue collection, but also the country’s economic competitiveness.

The Investment Fund appears

The establishment of an Investment Fund for the Support of the Business Environment of private equity type in complementarity with the Investment and Development Bank (which will become operational by the end of this year) is another measure considered by the Government through the PFSTM. Its capitalization would be two billion lei, and the money will come from the Privatization Fund.

Centralized procurement to reduce public spending

The introduction of centralized procurement together with the approval of the legal framework specific to centralized procurement, including the possibility of establishing centralized procurement units at the central/local level is another objective of the public expenditure reduction plan. Its completion is scheduled for the third quarter of 2025. Also, by the end of the fourth quarter, it is desired to operationalize the specific structure for monitoring with the help of performance indicators of the public expenditure system, as well as the training of specialized staff in monitoring the performance indicators of the expenditure system public with the support of the World Bank.

››› See the photo gallery ‹‹‹

››› See the photo gallery ‹‹‹

Source: jurnalul.ro