More than 14,000 entrepreneurs ceased operations last year, and less than 800 of them received compensation for the period of unemployment.

The status of an independent entrepreneur, which is supposed to be a springboard for success in the world of entrepreneurship, also brings with it a number of disadvantages, which relate mainly to the field of social welfare. The most well-known drawback of this status is certainly the unpaid sick leave for the first 20 working days, as well as the more difficult access to unemployment benefits if the business idea fails. Regularly employed workers who, through no fault of their own, become unemployed, simply apply to the employment office and agree with the clerk on receiving compensation.

Primorska news

Self-employed entrepreneurs must prove that they are no longer able to continue their entrepreneurial journey. Often such evidence comes when an individual’s financial security is already well established.

Evidence is important

Self-employed entrepreneurs, even if they foresee a deterioration in business, cannot simply stop their activity and count on automatic compensation. As explained by the employment office, insured persons who were not insured on the basis of an employment relationship cannot assert the right to monetary compensation, if the deregistration from all social insurance was not the result of objective reasons. “Objective reasons for canceling insurance include, in particular, long-term illness of the insured, insolvency, bankruptcy, natural disaster, major material damage to the insured’s property, loss of business premises or loss of a business partner to whom the business was predominantly linked, and others comparable objective reasons.’

At the same time, they add that insurance rights are acquired by the insured who was not included in the unemployment insurance based on the employment relationship, solely on the basis of the payment of the unemployment insurance contribution.

Leo Caharija

Clerks at the employment office decide on each case individually.

Referees with different criteria?

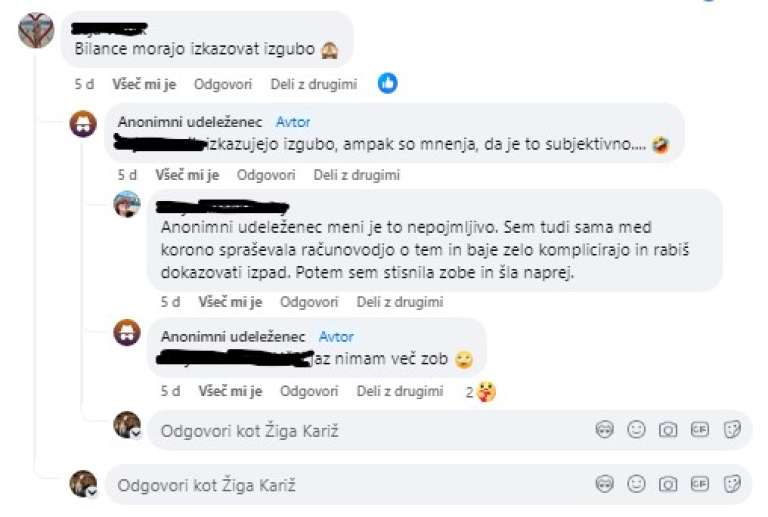

But the experiences of independent entrepreneurs who were forced to end their business journey show that the road to compensation can be extremely thorny. Some time ago we came across the story of an entrepreneur who found himself in trouble: “After five years, I closed the sp due to a drop in income and submitted an application for monetary compensation at the institute, where they tell me that the stated reason for closing the sp is subjective and that an objective reason is needed. What advice would be useful? How do I explain that I no longer have clients and income? My annual balance was not a sufficiently objective reason for them.” The writer went on to explain that his sp had a negative balance, but this was not a sufficiently objective reason for the clerk to approve the compensation. In the comments on his post, it turned out that his story is not an isolated one.

Appeals to the Ministry of Labour

The employment office confirmed that they are the ones who decide on the right to the payment of cash compensation, but everyone who submits an application must support this with evidence, such as proof of temporary incapacity for work, any acquired category of disability, medical certificate selected doctor, in the case of a natural disaster, this is a copy of the record of the damage report, photos of the damage caused… But as it seems, the clerks are quite careful when evaluating the evidence free, and what is enough for one person is not enough for another. It is also possible to appeal against the decision of the employment office, which is handled by the Ministry of Labour.

(Un)successful entrepreneurs

Data for the last five years show that more than 10,000 self-employed entrepreneurs cease their activities in Slovenia every year. Last year, as many as 14,000 of them closed down, 13,000 the year before, and almost 10,000 by August this year. The reasons can be different: retirement, transition to business within a limited liability company, regular employment and, of course, bankruptcy or insolvency. The employment office does not record information on how many of those who close their business and then submit applications for compensation, they only keep track of the number of those who actually receive compensation. In 2021, an average of 806 people received compensation, in 2022 864, last year 787 and this year until September 746.

Sole proprietors have different experiences at the end of their operation.

How much is the compensation

The basis for assessing self-employed cash compensation is the average basis from which contributions were paid in the period of eight months before the month of unemployment. From the base determined in this way, monetary compensation is assessed for the first three months in the amount of 80 percent of the base, and in the following nine months in the amount of 60 percent of the base. After the end of this period, monetary compensation is paid in the amount of 50 percent of the base. The minimum amount of monetary compensation must not be less than EUR 530.19, and the maximum amount must not be more than EUR 892.50 gross.

Profimedia

There is a lot of bad blood, especially among the parent entrepreneurs.

Source: svet24.si