While trust in Turkey is on solid ground in international markets, credit rating agencies are crowning positive developments with high ratings. Before Moody’s will announce the rating today, experts made statements that will guide the markets and investors’ preferences. Experts, who expect record after record in the dollar, euro, gold and Borsa Istanbul, are certain that Turkey’s rating will increase.

Burak TAŞÇI – Hurriyet.com.tr Economy Service

Reforms in the Turkish economy continue to be accepted in international platforms. While financial and monetary regulations pave the way for economic recovery, the rationally grounded policy rate supports the Turkish Lira.

International organizations also continue to take the necessary steps to reward the efforts.

Today, international credit rating agency Moody’s is expected to evaluate Turkey’s rating and outlook. Expected to be announced after 23:30, the expectation of a rating increase is high.

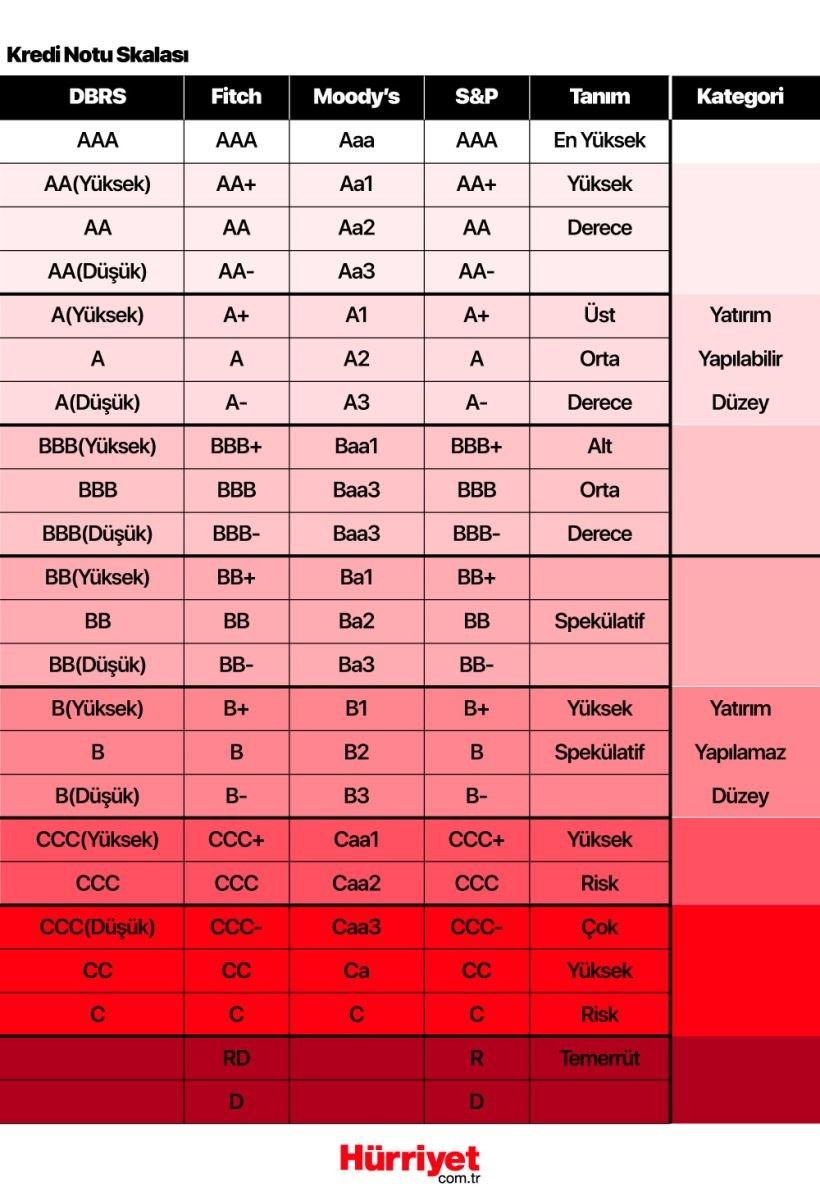

Although the ratings given by Fitch, Moody’s and S&P have not yet reached an investment grade, credit rating agencies that will evaluate the positive image formed in each evaluation period continue to make moves.

WHAT IS THE CURRENT STATUS?

Currently, Fitch’s credit rating is B2 with a positive outlook, Moody’s is B3 with a positive outlook, and S&P is B+ with a positive outlook. According to the ratings of the three credit rating agencies, Turkey is at a “Non-Investment Level”.

DOES MOODY’S’İN SATIN CARE PROTECT ME?

When we look at the markets, Borsa Istanbul continues to break record after record. Especially the intense purchases in the banking sector support the rise. The expectation of a positive assessment from Moody’s carried Borsa Istanbul to 11,252 points. BIST investors seem to have bought Moody’s decision in advance.

CENTRAL BANKS ARE ON THE WAY TO REDUCE INTEREST RATE

It is expected that other central banks, especially the US, will start to reduce interest rates. With the interest rate reductions made by central banks, the high interest given to deposits means that the high interest used in loans will decrease. Thus, investors who think that they will earn less from deposits are starting to turn to other instruments. Gold and the stock market are at the forefront of this. The first effects of the steps that central banks will take in the future are expected to be seen in the stock market and gold.

WHAT DO EXPERTS PREDICT?

Experts who consider the period until the end of the year state that there is an increase in the dollar and euro, a slight decrease in interest rates, a positive development in rating performance, an increase in Borsa Istanbul to 15 thousand points, new records in gold parallel to the Fed’s interest rate cut, and good options in funds.

Eral Karayazici

Inveo Portfolio – Fund Management Manager

“INTEREST RATE REDUCED IS THE FAVORITE SCENARIO”

The start of the Fed rate cut cycle abroad in the near term is a candidate to be the main pricing issue. The favorite scenario is for the US Federal Reserve to give a concrete signal at the meeting on July 31 and make the first rate cut on September 18. It seems likely that the positive mood will continue unless an unexpected risk is realized in this calendar section. What happens next depends on the area to be covered until that day.

“BIST MAY CLOSE THE YEAR WITH 15 THOUSAND POINTS”

I find it highly probable that BIST will rise to the $375-400 band in the last two months of the year. For Borsa Istanbul, whose current value is $339, this means a 14 percent return potential in a 4-5 month period. The USDTRY year-end exchange rate is 39.5 in the futures market. If the year closes close to this level, the index could end 2024 at around 15,000 points.

“GRADE INCREASE CUT”

The rating increase is almost certain. If you ask if there could be a surprise and a two-notch increase, it is not impossible, but the probability is extremely low. If BIST had reached around 11,800 before the decision, there could have been concerns about an oversold expectation. However, that did not happen. BIST is increasing at a moderate pace and it would be unfair to talk about an overshoot.

Therefore, I do not think that the possible rating increase will have a negative impact. If you ask whether it will have a positive impact, it is difficult for it to create a permanent momentum since the decision is not a surprise. Moody’s will not reveal information that market actors do not know.

“A STRONG RECORD IS FORESEEN FOR THE DOLLAR AND EURO”

In the futures market, the year close is 39.5 for USDTRY and 43.2 for EURTRY. I think the realization will be close to these values, but the parity may move in favor of EUR and move the board to a balance like USD 38.5 / EUR 44.0.

“CBRT WILL REDUCE INTEREST RATE AT THE END OF THE YEAR”

This issue is critical. The interest rate reduction cycle is starting worldwide and this wind will also affect Turkey. Interest rate reductions that start at the right time and progress at the right pace will not have a negative impact on global funds. However, it is difficult to answer the question of how residents will look and what they will do. There will be those who buy foreign currency thinking that the exchange rate had increased sharply in the 2021 interest rate reduction cycle and this could happen again. The possibility of their purchases may encourage some global funds to exit the Turkish Lira before them.

However, the CBRT dominates the foreign exchange market and can easily manage this risk by providing the required liquidity after the first rate cut (just like in the last local election).

In this critical exam, which I believe is not a major challenge, the business world and the media need to be calm and patient so that the burden on the Central Bank does not increase and the issue does not turn into a difficult one.

Considering all these factors, I think that the CBRT will start the interest rate reduction cycle in December and continue this with slow and confident steps in 2025.

“GOLD ONE OUNCE MAY TEST $2700”

The expectation that the FED interest rate reduction cycle will begin and that real interest rates will also fall is positive for gold. It would not be surprising to test the $2650-2700 band in the second half.

“FED MAY MAKE 3 INTEREST RATE CUTS”

If the data for the coming months is supportive, three interest rate cuts this year are possible and probable.

“STATISTICS ARE INSUFFICIENT IN FUNDS”

There is very strong competition in the domestic fund market and I think there are many well-managed options within local funds. A very significant portion of these funds are field instruments.

Namely, Eurobond BIST precious metal or foreign sector stock funds. Each of these funds has and will continue to have sections where they can stand out and have advantages. The exception is the family happy picture paintings. Not every fund passes every track in the same way. Therefore, making a choice and changing the funds from time to time is a must for this business. When it comes to analysis, a large portion of investors turn to statistics. Of course, this has a meaning, but it is insufficient and even misleading on its own. Fund analysis is not looking for an answer to the question of what the past 3-6-12 months have brought in. If this were true, history would repeat itself and the most successful investors would be history professors.

If you ask what the solution is, I think everyone, especially investors who do not have a high level of knowledge, should receive investment consultancy services from authorized institutions.

I believe that this will be the new competitive area for investment institutions and banks in the coming years.

Dr. Erkan Kork

Chairman of the Board of Directors of BankPozitif

“POSITIVE WEATHER WILL HAVE AN IMPACT”

The data shows that we are on the right track and the economic program is working well. We are off the gray list; our CDS premium continues to remain at historically low levels. The disinflation process has begun, there is no exchange rate risk, there is no problem with fiscal discipline. The current account deficit has fallen sharply. It will continue to fall in the coming months. This positive atmosphere will also have a positive impact on the markets. Our country has great potential. That is why I am very hopeful about the future.

“I EXPECT A RECORD IN BIST”

The BIST100 index recently passed the 11,000 threshold. I expect short-term portfolio investments to increase even more in the next few months. This increase will also bring new records in the index. I believe the rise will continue. The target for BIST100 is now 15,000 points. I expect the index to close the year at levels close to this target.

“MOODY’S MAY INCREASE BY TWO STEPS”

I definitely expect a rating increase from Moody’s. It is even possible that this increase could be made by two notches. Markets have started to price in the rating development, but the announcement of the rating decision will have a doping effect. I think that short-term portfolio investments will start coming gradually, especially starting from Monday.

“MY YEAR-END DOLLAR PREDICTION IS 35-36 LIRA”

As you know, the Central Bank of the Republic of Turkey conducts market participant surveys at certain intervals. According to June 2024 data, the year-end exchange rate expectation was 37.75 on a dollar/TL basis. I think we will close the year much lower than this level. The exchange rate has been moving sideways for a long time anyway. I expect the year-end dollar/TL exchange rate to be in the 35-36 band and the euro/TL exchange rate to be in the 38 band.

“THE CENTRAL INTEREST RATES WILL BE REDUCED”

The disinflation process has begun, but it is too early to talk about interest rate cuts and make predictions about them. I expect the rate of decline in inflation to accelerate further during the summer due to the base effect. Therefore, I think that there may be a small reduction towards the end of 2024, depending on the picture that will emerge in the first months of autumn.

“A GRAM OF GOLD WILL SEE 3 THOUSAND LIRA”

The demand for gold is high all over the world, including our country. The performance of the ounce of gold will give us clues about the upcoming period. The decline in inflation in the US indicates that interest rate cuts are approaching. Even if there is a 10 percent increase in the ounce by the end of the year, I think that 3 thousand TL levels can be seen in the gram side due to the change in the dollar/TL exchange rate.

“FED WILL MAKE 2 INTEREST RATE CUTS”

June inflation was of critical importance to the Fed. Indeed, the data released was consistent with the soft landing targets. Of course, time heals everything, so bank officials will want to see July and August inflation as well. If the inflation data for these months also indicate a decline, it will be inevitable for the Fed to cut interest rates in September. I think that if things go well for the US this year, there could be two interest rate cuts.

“FUNDINGS ARE SAFE HARBOR”

There are many areas where money can be evaluated for investors, but investors are interested in areas where they can get high returns and at the same time have minimum risk. In parallel with this, the number of fund management companies and the amount managed by these funds are increasing day by day. It would be a right decision for investors with insufficient financial literacy to prefer funds. There is a parallel return graph between the return of the funds and the BIST100 index. Therefore, the investor does not lose. Investors with a small amount of money can also create a basket thanks to the funds. It is beneficial for small investors to entrust their money to professionals in order not to be victimized. Funds are a safe haven in this sense. I think that interest in funds will increase even more in the coming period.

Source: bigpara.hurriyet.com.tr