Hi all,

We continue to research how much mobile communication tariffs cost in different countries of the world in order to better understand how Russian subscribers live. It is also a kind of benchmark that allows you to evaluate Russian operators.

In previous materials we studied France, Latvia, Kyrgyzstan and Korea. We were unpleasantly surprised by the prices in Kyrgyzstan and Korea, where citizens spend more than 2% of their average monthly income on mobile communications. However, in return, operators give subscribers either large 4G LTE packages (100 – 240 GB), or completely unlimited 5G.

The examples of Kyrgyzstan and Korea make us think that if subscribers in Russia paid 1500-2000 rubles for communication, then operators would be able to improve the quality of coverage and offer larger Internet packages.

Reflecting on this topic, I remembered Kazakhstan and thought that this was a great opportunity to discuss how tariffs are structured in this beautiful and technologically advanced country.

In the ranking of the OOKLA application, which should be banned in Russia, Kazakhstan occupies an honorable 54th place and is ahead, for example, of Japan (58th place), Israel (62nd place) and Russia (92nd place). We will definitely talk about Japan, too, because it is a very interesting country where there is 5G, and tariffs cost $50, but at the same time we do not see prohibitive speeds. I don’t know about you, but for me Japan has always been associated with cyberpunk from the world of the future, so it’s strange that the country has slow mobile Internet.

But let’s return to Kazakhstan. The country has already stepped one foot into the bright 5G future, and the other is still firmly planted in 4G. And Kazakhstan will apparently remain like this for a long time, because, for example, the local Beeline still does not have 5G. Here’s how the operator commented on the situation:

…participated in the auction for 5G frequencies. However, not only did we not play for a raise, but we also did not make a single bet at the auction. The price at which the frequencies were sold is unprecedented and beyond our business performance calculations. In this situation, the operator will improve 4G – the most widespread generation of communications, whose potential has not been fully realized. However, if conditions appear that are more suitable for Beeline, the company is ready to begin developing new technology.

But Tele2 Kazakhstan, with 5G networks, calls itself the fastest operator in the country of endless steppes. Tele2 launched the first 5G networks back in 2021. By mid-2023, there were about 1,000 5G base stations operating in the country. Initially, licensing terms required operators to deploy 7,000 5G base stations across Kazakhstan by the end of 2027. However, President Kassym-Jomart Tokayev called on operators to achieve the goal by the end of 2025.

Kazakhstan is a gigantic country, so only populated areas and key routes are covered by the network, and even then not always and not all. And in terms of the quality of coverage, Kazakhstan, of course, cannot be compared with Russia. But the Kazakhs don’t have the same resources. The country, which is approximately the same area as the European part of Russia, has a population of only 19.89 million people. So there is no economic feasibility to cover the entire country with a mobile network. Rather, for Kazakhstan in the future, the solution will be a mobile network in large cities and affordable satellite communications in the rest of the country.

However, both tourists and city residents complain that even in the center of Almaty and Astana, the speed of mobile Internet is far from ideal. Beeline in one of the interviews complainedthat it is too difficult for operators to obtain permission to install base stations:

If operators had the legislative ability to install base stations where necessary and draw up documents in a simplified format, then work to improve coverage would be much more effective. Beeline warehouses store components for hundreds of base stations that are not installed due to coordination difficulties

(Note: I would like to say that if you don’t need BS, then give them to those who need them more)

However, according to reports from the pro-Western service OOKLA, Kazakhstan is actively investing in construction. So in 2022, the country was in 92nd place in the mobile Internet speed ranking, and now it is about to enter the top 50.

But the population seems to be slightly behind. According to the same OOKLA, which is in for trouble in Russia if it doesn’t come to its senses, at the end of 2023 only 53% of network speed measurements were taken from devices that support 5G. That is, 47% of measurements were taken from old or inexpensive devices.

This is a great opportunity to talk about the income of Kazakhs. According to the Bureau of National Statistics of the Agency for Strategic Planning and Reforms of the Republic of Kazakhstan, the median salary value (the central level of the salary series) in the second quarter of 2024 was 278,296 tenge, or 55,345 rubles. And the average nominal salary was 403,251 tenge, or 80,195 rubles. The figures are almost the same as the Russian average. Thus, according to SberIndex, the median salary in August 2024 was 59 thousand rubles, and the average salary in July, according to the Vedomosti newspaper, which refers to the report “Socio-economic situation in Russia,” was 85,017 rubles.

If you follow generally accepted logic, then mobile communications tariffs should account for 0.5-2% of citizens’ monthly income, that is, be no more than 8,000 tenge. Let’s see what it really is.

How much does mobile communication cost in Kazakhstan?

We will study mobile communications using the example of the operators Tele2, as the leader in 5G construction in the country, and Beeline, as an operator with a subscriber base of 11 million Kazakhs. Plus, Beeline communicates quite actively with its subscribers and is not afraid to answer pressing questions.

Entering the website, you immediately notice how proud Tele2 is of its 5G network. I even included the icon in the title.

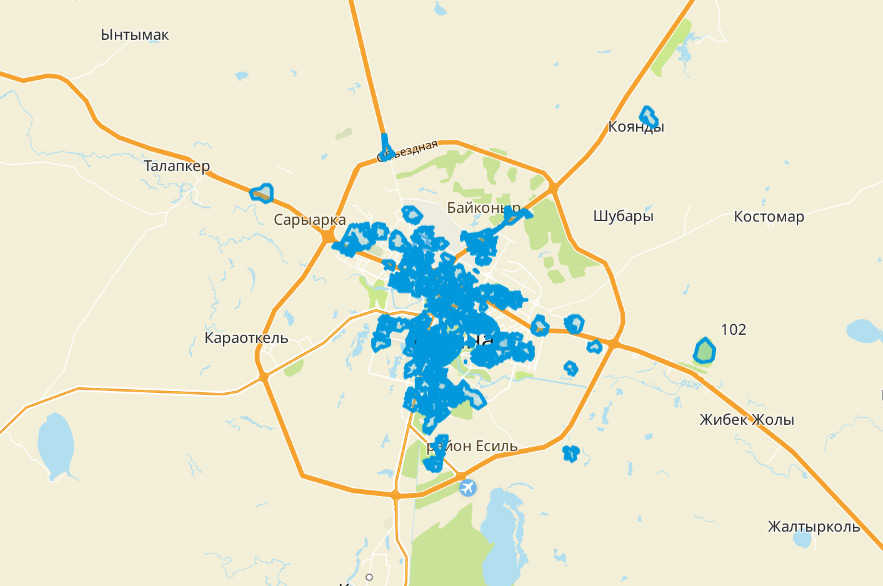

Although the operator’s 5G coverage is sporadic. At the same time, Tele2 makes it difficult to evaluate the network map. On the website, the operator offers to view coverage exclusively for a specific locality. For example, this is what 5G looks like in Astana.

Along the way, I noticed that Tele2 is completely saturated with IT movements and positions itself as a leader in this topic. I couldn’t get past this picture about the gap in borders (they could have sent base stations across the gap more actively).

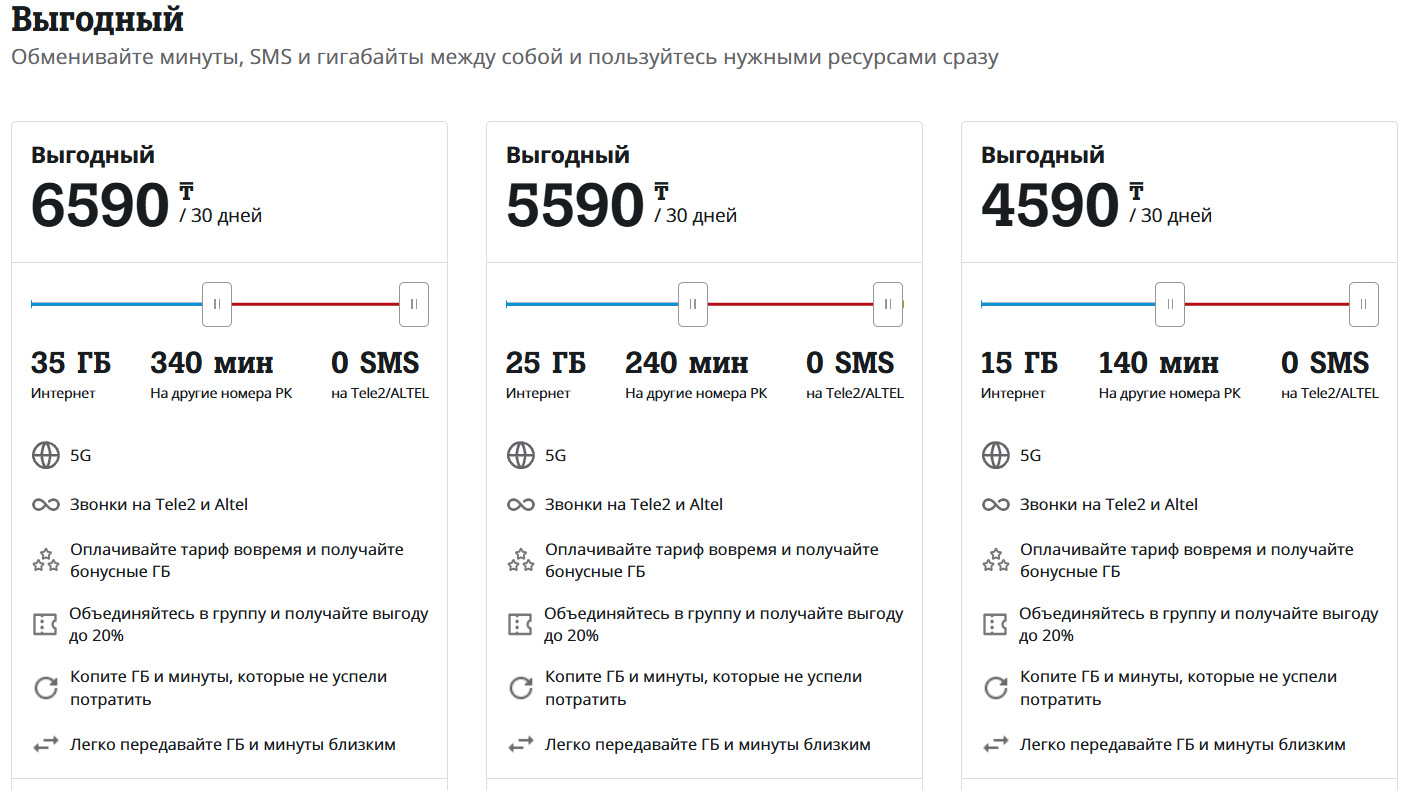

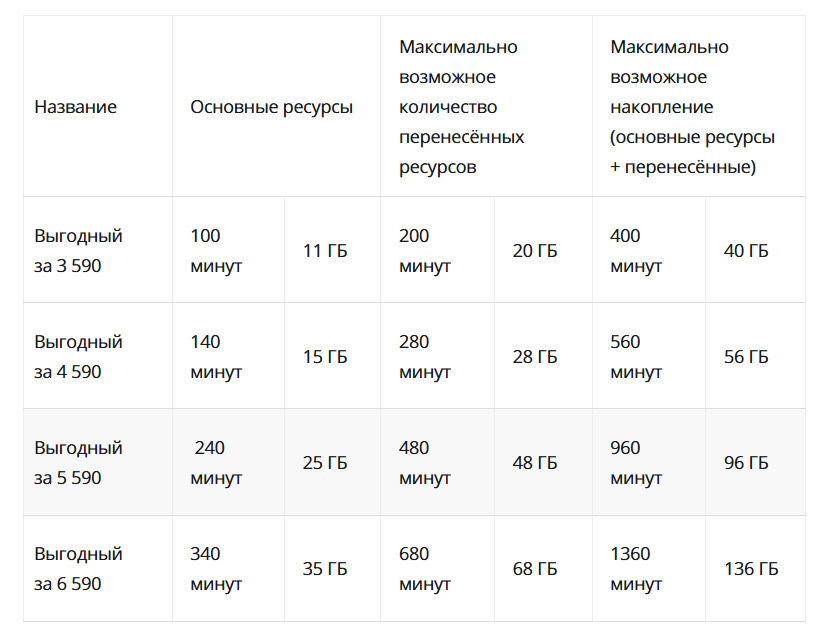

But the approach to tariff pricing surprised me. It seems like this is the first time I’ve seen this. The operator offers three “Favorable” tariffs, in which the subscriber himself cleverly chooses the number of gigabytes, SMS and minutes. This is done in a very strange way. There are two sliders under the tariff price. For example, you move the central one to the left and the number of gigabytes increases, but the number of minutes decreases. And SMS is initially zero in all tariffs. And by adding SMS, you have to sacrifice the number of minutes and gigabytes. I recorded a video for you.

So the breakdown is:

- for 6590 tenge, 1311 rubles, the subscriber receives from 1 to 68 GB of Internet, from 10 to 680 minutes and from 0 to 3300 SMS;

- for 5590 tenge, 1111 rubles, a subscriber can receive from 1 to 47 GB of Internet, from 20 to 480 minutes, from 0 to 2350 SMS;

- for 4590 tenge, 912 rubles, the subscriber receives from 1 to 28 GB of Internet, from 10 to 280 minutes, from 0 to 1350 SMS.

One of the nice features is the ability to save gigabytes that you didn’t have time to spend. However, there are no such bounties as the Russian “t2”, when you can accumulate 1 TB in Kazakhstan. Depending on the tariff plan, the operator determines the maximum amount of gigabytes that one subscriber can accumulate.

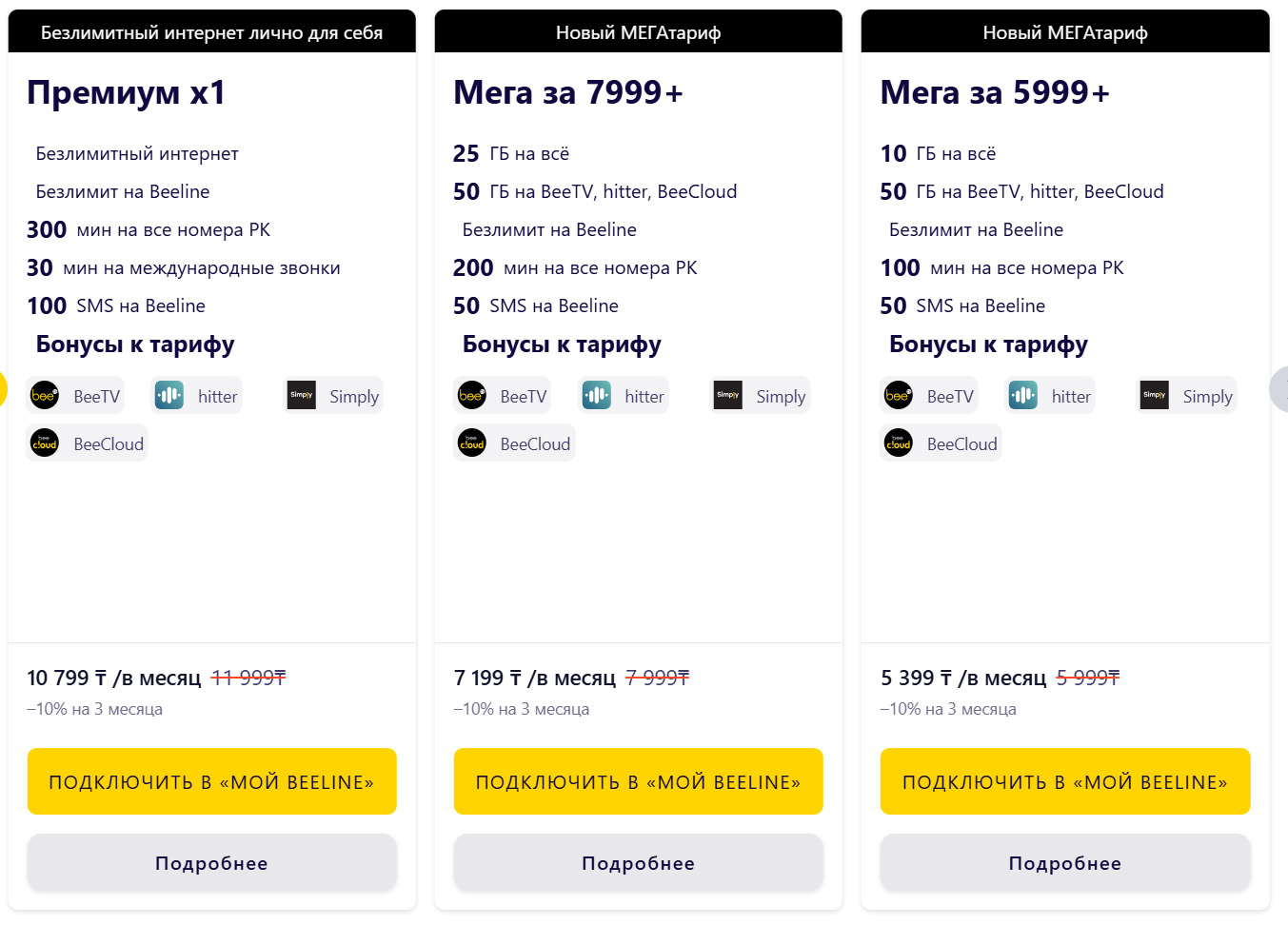

Out of curiosity, I went to evaluate Beeline’s tariffs. This operator pleased with its simplicity, but surprised with its prices. Beeline does not have 5G networks, but it has unlimited 4G for 12,000 tenge, or 2,386 rubles. But the tariff for 25 GB costs 8,000 tenge, or 1,590 rubles. These are high prices, both by the standards of Kazakhstan and Russia, given that the countries are approximately equal in terms of salaries.

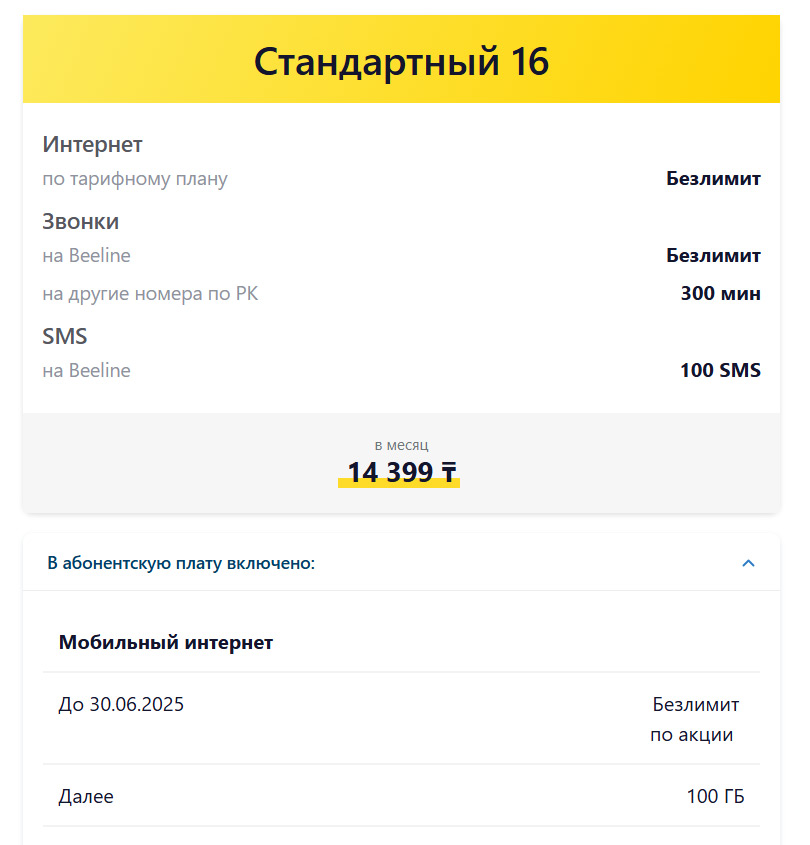

The description of the tariff looks especially interesting. So Beeline writes:

The terms of the tariff plan are valid for 12 months after connection. This means that if the specified period is not extended by the operator, the tariff head number will automatically switch to the “Standard 16” tariff plan. You will be notified in advance and, if desired, you will be able to switch to any other tariff available on the website or in the “My Beeline” application.

The “Standard 16” tariff plan is valid until 10/01/2027. This means that if the period is not extended by the operator, the tariff plan will automatically terminate on the specified date.

That is, the subscriber buys a tariff plan for 12 months, and then the operator looks at the economic situation and either extends the tariff or changes the conditions. And then the subscriber will need to connect the tariff under new conditions. If a subscriber misses the end of the tariff, he will be switched to the “Standard 16” tariff, which costs 14,400 tenge per month (2,864 rubles). The description of “Standard 16” is also encouraging. It says in big letters that the Internet is unlimited, but only until June 30, and then 100 GB.

Our operators have a lot to learn here. Although the idea that the tariff plan is valid for 1 year, in general, can have a positive effect on the development of cellular communications in our country, since Russian operators will be able to better cover the subscriber base and collect more money.

In passing, I would like to note that Beeline’s conditions, although difficult, are written in a visible place, and not in small print at the bottom. That is, in theory, the subscriber is warned in advance.

Prices from Beeline, and indeed from all mobile operators in Kazakhstan, are quite high. It is all the more surprising that Beeline published on its official website appeal to your subscribers regarding this matter. I recommend reading it, as the operator analyzes the situation point by point (traffic growth, increase in equipment costs, inflation, etc.). Some of our operators should learn from the Kazakhs how to communicate with their subscribers.

Conclusion

Kazakhstan inspires with its development. Prices for mobile communications cannot be called cheap, but they seem to allow operators to develop: improve coverage, introduce new technologies.

The concept also looks quite promising when you can buy an unlimited tariff at a high price (you pay 2,400 rubles and there is no limit). In Russia, this is probably impossible at the current stage, because the networks will be overloaded.

In general, perhaps, I would like to say that tariffs for mobile communications in Kazakhstan look more market-oriented.

Instead of indexation, Russian operators should think about how to introduce the concept of “tariff validity” so that, for example, tariffs work for 1-3 years, and then the subscriber would have to choose something from a fresh line.

But the main question is whether the price increase will have a positive effect. After all, now the key problem of operators is not only the lack of funds for development, but also the shortage of equipment. Agree that prices should be raised for the sake of active network construction, and not to pay fat bonuses to top management.

Source: mobile-review.com