Hello.

To some extent, our market is cyclical, the same processes occur on it, and if you have the opportunity to observe it for a long time, then the running in a spiral becomes clearly visible. Once upon a time, Nokia knew how to create excellent budget devices, but then they encountered Chinese manufacturers and a company like Motorola, which began to eat away at sales on both sides. Having hesitated in moving production to Asia, the company simply could not achieve efficiency in the cost of its devices, began to lose the market and, as a result, rush around in attempts to level out the decline in budget devices. At some point, the idea arose that they were not important at all and did not play a big role. The company itself forgot about the meaning of such models, how sales are built and why it is not so important to make money on budget devices here and now, they forgot how they fill the sales funnel in the future. Refusal of such devices is the first sign of shifting to the strategy “but we make money and we have a margin, and market share is not important.” And if you remember the names of everyone who played this game, the list will be long: Sony, Ericcson, SonyEricsson, Sony again, Siemens, Nokia, Samsung, and most recently Xiaomi joined them. Repeating the steps of other companies occurs somewhat unconsciously, without much analysis of the situation. This also happens in large companies that they are intoxicated by their success and turn a blind eye to long-term strategy. From a human point of view, it is possible to understand top managers who work here and now. What is the point for them to think about what will happen in five to seven years, they don’t know where they will work and what they will be responsible for. They have a headache about today.

And as of today, Xiaomi is doing great by any standards; the company has crawled out of the crisis of previous years and has gained momentum by entering new markets, in particular, by creating its first car. The future is painted in rosy colors. Let’s take a look at the company’s quarterly report, last available for the second quarter of 2024.

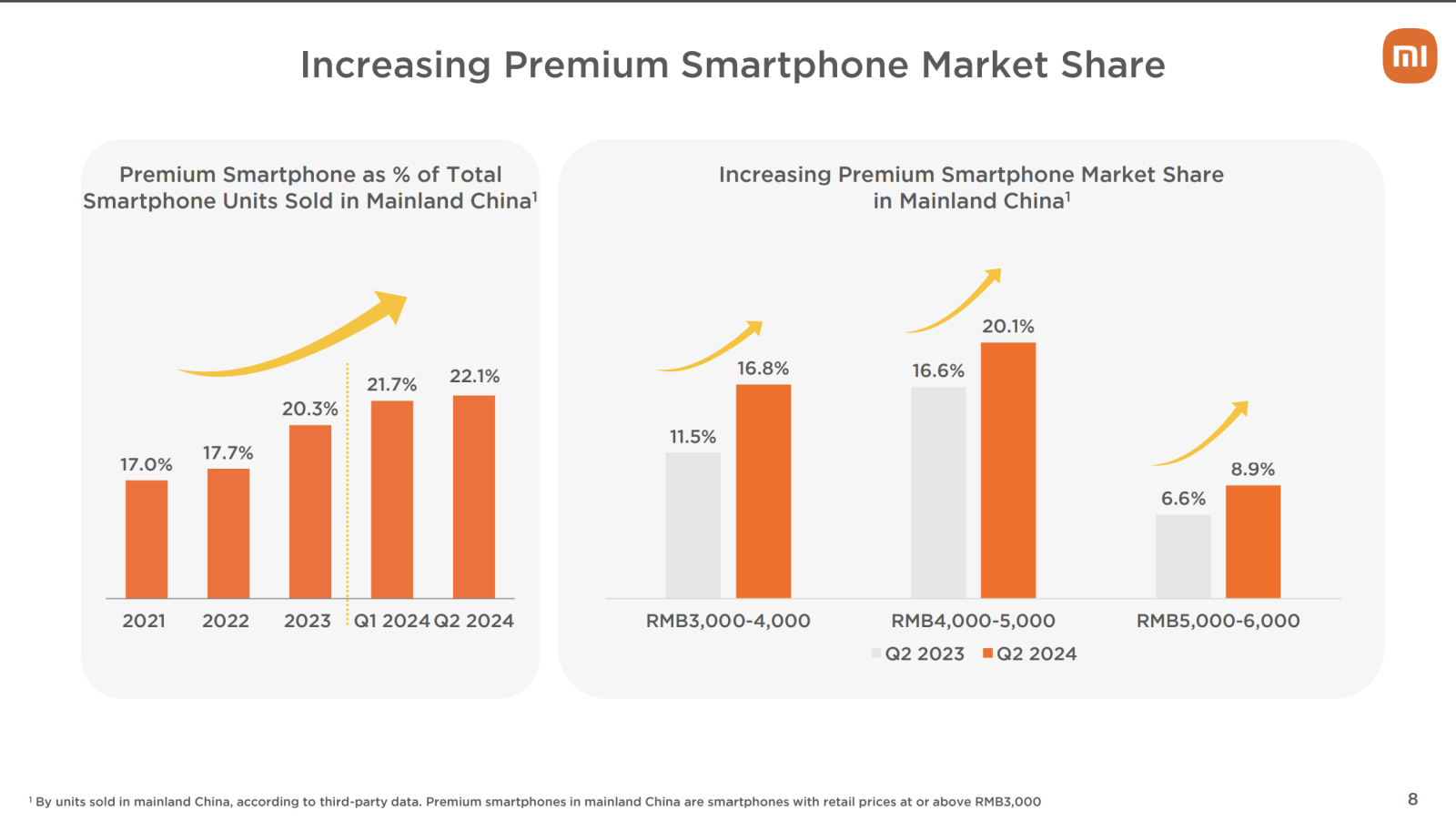

The company is number three in the smartphone market in the world, growing faster than its competitors. An ideal picture of the world, isn’t it? The report indicates that the number of premium models is also growing (price above 3,000 yuan, more than 40 thousand rubles – that’s like putting an owl on a globe, but still).

At the same time, let’s see how the number of retail stores that offer Xiaomi equipment in China is growing.

To call devices that cost about 40 thousand rubles and more premium is beyond my tongue. Rising prices on the market have shifted segments; today the price of premium models is one hundred thousand rubles and higher (flagships, smartphones with flexible screens). If you look at the initial cost of flagships and models close to them, you can slightly shift the segment to 75-80 thousand rubles, but not lower. Data manipulation is visible to the naked eye; note that on the slide with data on premium sales growth on the right side we see the growth of each price segment in China. The stunning growth of this market is not due to the successes of companies, but to the fact that the cost of smartphones is growing before our eyes and what yesterday fit into the lower price segment has simply become more expensive. There is no conscious and galloping demand from buyers; if they had the opportunity to spend less money, they would buy goods cheaper, but the average price of a smartphone is growing in all markets, including China.

Xiaomi has divided the market into several price segments, so Xiaomi is a premium brand with high margins, prices calculated from Apple and Samsung, and sometimes they correspond to the same Samsung. But the main sales come from brands such as Redmi and, to a lesser extent, Poco. The Poco brand emerged as a brand with products where you can turn a blind eye to quality, remove several technological processes from the chain, but still give the lowest cost to the buyer. Typically, Poco was aimed at developing markets, where the quality of the devices did not play a big role.

At the same time, Xiaomi tried to convince everyone that Poco is a separate brand, has no relation to Xiaomi and cannot be perceived in connection with the company. The reason for this strange step was precisely the quality of the product; the company wanted to remove additional risks. And here we can say that they not only existed, but were put into practice, and in many ways the quality of a particular product depended on a specific batch, and not on the model of the device. Here’s what our reader wrote about Poco:

“In 2021, Poco began to actively gain momentum. I was led to believe that it was the same Xiaomi, only cheaper. I took two Poco M3s for my relatives. I’ve never seen a more disgusting phone. A bunch of problems, ranging from crooked wi-fi to periodic system boot failures. Judging by the reviews on the Internet, this model died in the first year for many users. We can still say we were lucky. One device died after 2 years, the second after 3. But since then I have stayed at gunshot distance from Poco.”

And in response, another reader talks about his experience:

“Hmm, strange, in those same years I took an M3 for my son to school, Wi-Fi never fell off (in any case, he didn’t complain), at the beginning it got stuck on reboot a couple of times, but the firmware has apparently been fixed a long time ago and there is no such problem anymore, The phone has been in good service for 4 years.. even the battery still holds up tolerably.. 64 memory is really not enough, but it’s quite a phone for the money it was bought.”

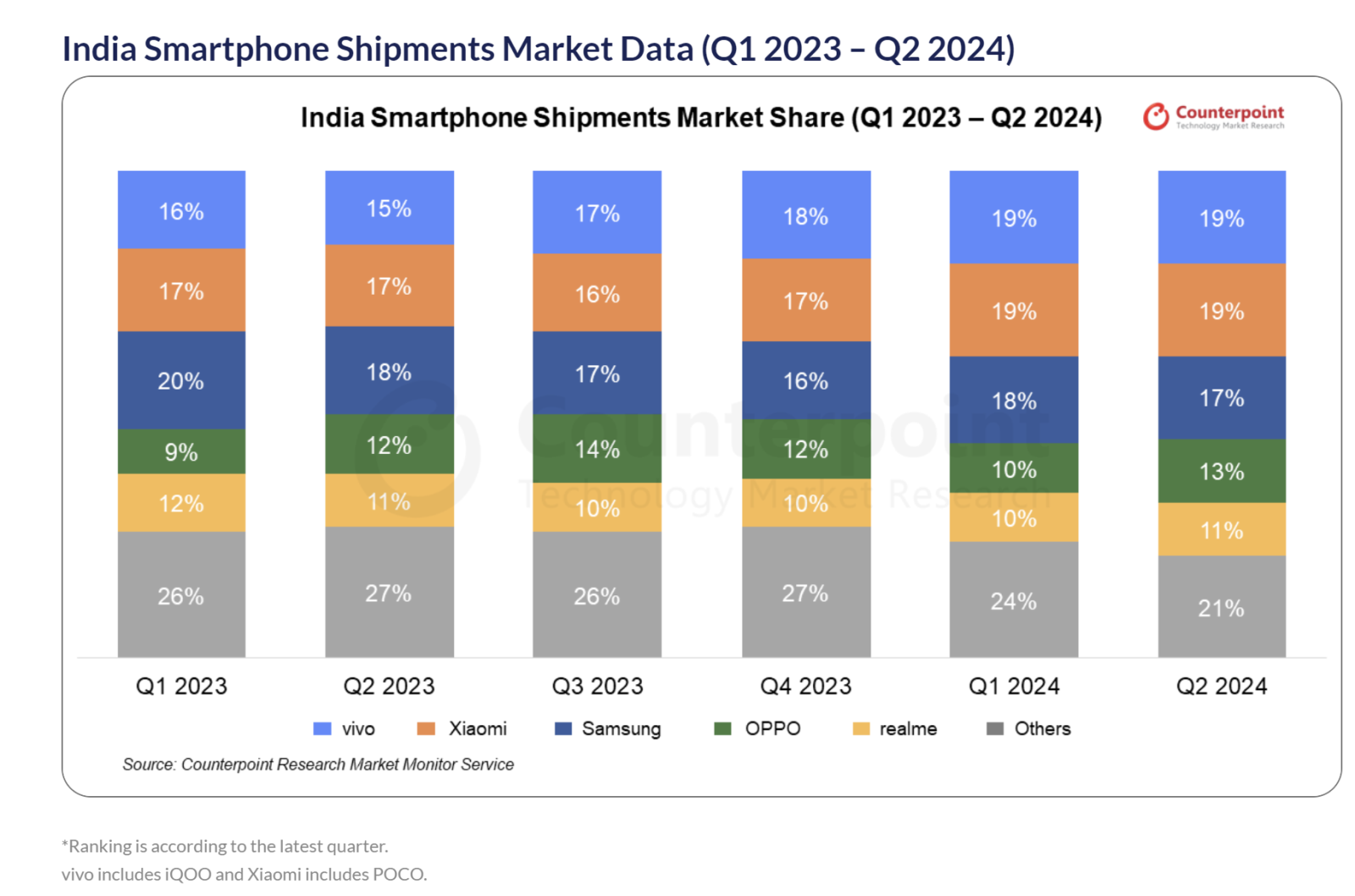

Both are right, no one is lying. Models from different batches or even from the same batch could behave in any way they wanted. You played roulette, but paid a minimum price for these machines. But starting in 2023, the strategy inside Xiaomi changed, and the company began to increase the cost of models; you can read the description of the presentation in May 2024, when Poco presented the next “flagship killers” at a cost not much different from them. In fact, there was a merger between Poco and Redmi, we saw the same models at the same price. The discount on the Poco model remained only for markets where Xiaomi’s share was quite low and it was necessary to increase sales. India can be considered such a market, where sales expansion occurred due to Poco.

From January 1, 2025, the Poco website will stop working, all models will move to the global Xiaomi website. And this step shows that the company is planning to kill the Poco brand, but is doing it gradually. As a tool, Poco is still interesting in India, but negative reviews of the model negatively affect the Xiaomi brand; it was not possible to separate the perception of Poco from the parent brand.

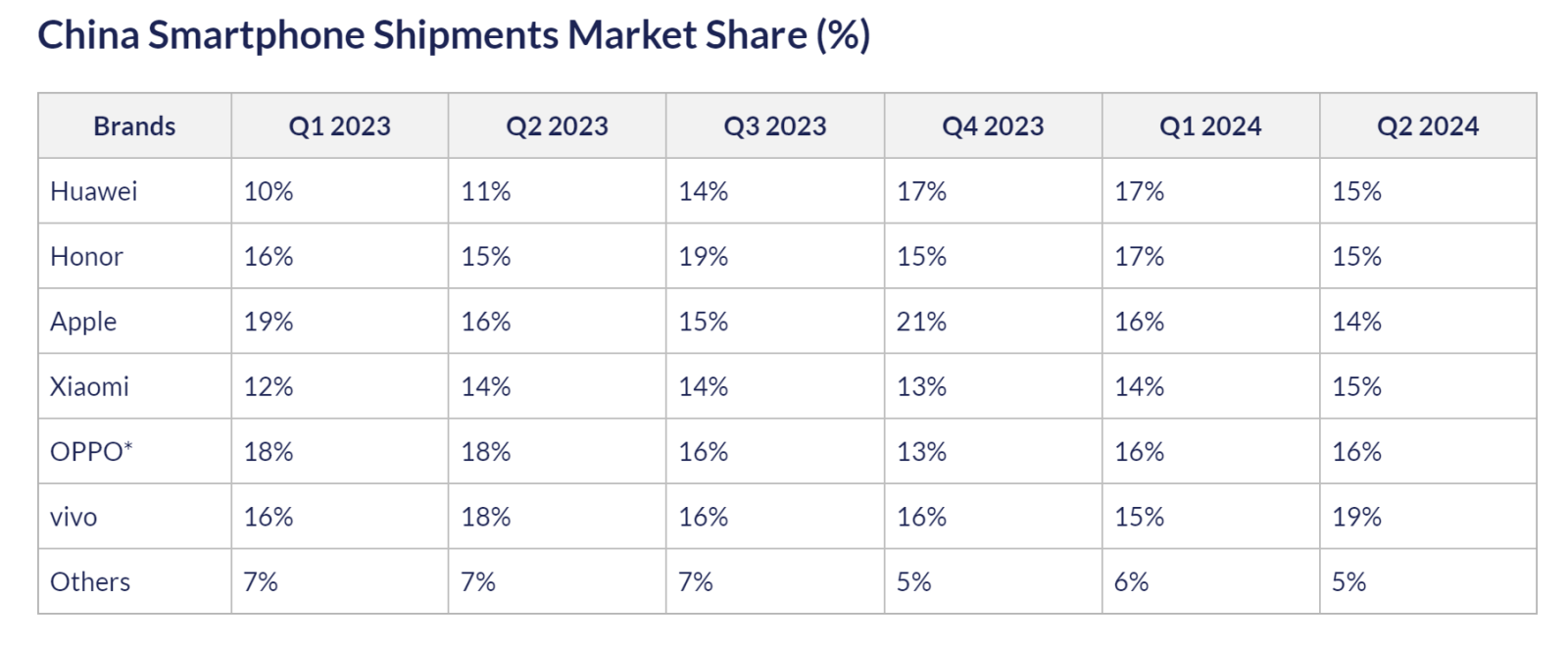

In the refusal of Poco and the increase in prices for these models, we see confirmation of Xiaomi’s strategy, which is focused on making profits, high margins, and going into the premium segment. But there Apple and Samsung still dominate in global sales, in China it is Huawei/Honor, as well as OPPO (with flexible smartphones). Xiaomi’s attempts to gain a foothold in the premium segment to date can be called unsuccessful. The same smartphones with flexible screens were unable to achieve any noticeable level of sales, even in their native Chinese market, where all the conditions were created for this. The company is not perceived as a manufacturer of premium products, hence all the marketing attempts to break this perception. Why does the company’s first car look like a luxury car? The answer is exactly the same, an attempt to create a different perception of the brand. But to do this, you need to pump money into marketing for many years, which Xiaomi does not know how to do, and by and large does not do, even in China. Hence the doom of this move into the premium segment, it will not sell itself, the buyer needs to be convinced that you can be present in this market (in Russia everything is even worse, the company is not active in this direction, the feeling is that its expensive products should sell themselves, but this does not happen at all).

When at the beginning I said that the market moves in a spiral, I was not mistaken. We see that the company is abandoning its original positioning, when it offered inexpensive, cheapest devices and this made up for all their flaws. Going into the premium segment imposes completely different requirements on products; here Xiaomi simply has not yet gained enough traction and gained the necessary experience. Their products do not even come close to the perception of premium models (there is an external copy of what premium is, but there is no corresponding content in software, service and similar “little things”). Without understanding the essence of premium products, nothing will happen, and competitors will not give up their market share for nothing.

In Russia and around the world, the company’s main sales come from Redmi; in fact, Poco is being abandoned in favor of this brand. And nothing changes here; we will have exactly the same products in front of us. But in the budget segment the company begins to give way to Transsion (Tecno/Infinix), which is clearly visible in sales in Russia. Both brands follow the path of Xiaomi, quickly create added value for their brands, and are perceived differently than just a few years ago. They pump budgets into marketing so that the consumer knows and buys them, and this has already happened for them; the Redmi brand is inferior to them in terms of sales efficiency. And in parallel, Tecno/Infinix are starting to create devices of a higher class (the same Phantom line from Tecno). They are not without shortcomings, childhood illnesses, but the approach here is exactly the same, to give an excellent price/quality ratio, exactly what Xiaomi refused. The idea of these companies is much stronger than that of Xiaomi today, where there is looseness in positioning, throwing between different products. The market moment for Xiaomi is excellent, it allows you not to think about the future, but at the next stage the company will simply have to choose what to do – persist in storming the premium segment or return to the middle segment, where competitors will gain better positions during this time. And this is where the confusion begins; this has happened in the market many times before. And Xiaomi will be no exception.

Source: mobile-review.com