Berkshire Hathaway, led by legendary investor Warren Buffett, published its economic results for the previous quarter over the weekend. At the age of 94, he is currently the tenth richest person in the world with a fortune worth 143 billion USD. With roughly 99% of his holdings in Berkshire Hathaway, the longest-serving CEO of the S&P 500, it’s in his best interest to run the company as best he can. The results themselves probably did not bring any great surprise in terms of the company’s management, but what we could read between the lines was more interesting. Warren Buffett and his people built this company by investing in the shares of other companies, which is one of the pillars of the company.

In this area, however, the results showed several interesting things. The first was that the company continued to sell Apple shares. The investment in this company has historically been the best that Berkshire has ever made, and until about a year ago Apple shares made up about half of the company’s investment portfolio. But Buffett gradually began to sell Apple, he continued to do so last quarter, and the current position in this company is only about a third compared to the size of a year ago. However, Buffett also sold other shares, for example, he also got rid of his stake in Bank of America. However, it can be even more interesting when we see what he does with the money. In short, it can be said that for several years now, the company has basically been accumulating cash, which is sitting on accounts in the form of short-term government bonds. Although they currently bear a fairly decent interest of approximately 4% per year (for the last quarter it earned about 3.5 billion USD in interest), however, the value of the cash parked in this way has already grown to an incredible 325 billion USD. This is truly an unprecedented value.

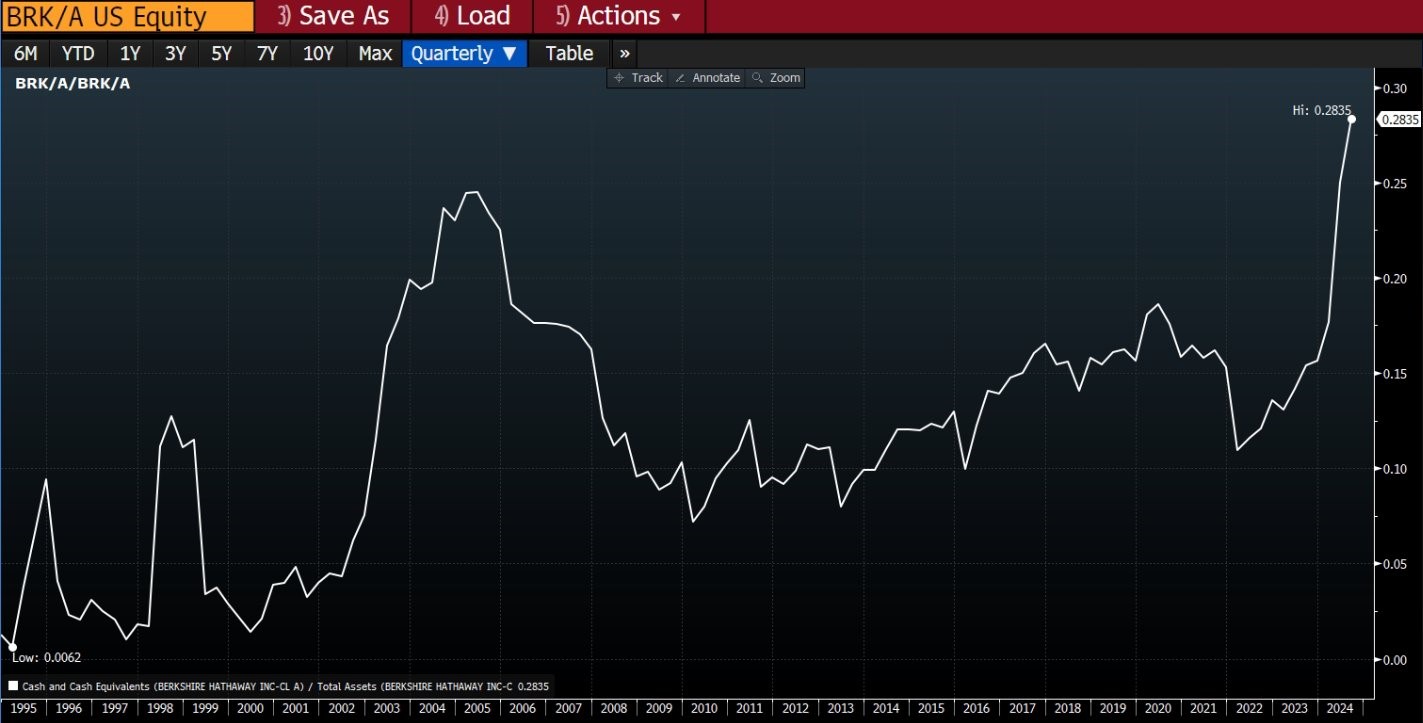

At this point, however, it should be added that in addition to cash, the size of the company as such is also growing, so it is perhaps a better indicator to compare its volume with, for example, the total assets of the company. Thus, cash currently constitutes more than 28% of the total value of the firm’s assets. Just for comparison, before the covid slump, the value was at around 18%, and before the outbreak of the great financial crisis of 2008, the value was around 25%, viz. picture.

Source: Bloomberg Terminal

In other words, Warren Buffett currently holds more money in the company than he did before the two major market crashes. One reason may be that the stock markets are simply high and he does not see a good opportunity in them. The second reason may be that he is preparing cash for his successor, who will be at the head of the company, Greg Abel. However, a third interpretation could be that Warren Buffett is expecting a recession or a crisis that can send stock markets down. In the past, he has shown several times that he has a sense of smell for similar situations and correctly waited with a large package of cash until the shares fell significantly and later started buying them at a significant discount. Of course, Buffett has not openly confirmed anything like this, but his latest steps may indicate something like this between the lines.

Of course, there is still a chance that he could be wrong, as he has been several times over the past few years, when he has made some bad decisions, such as buying airline stocks, selling TSMC stock, or buying Paramount stock. One of the interpretations could also be that the company is waiting for the results of the US elections, but of course it could be something completely different. Of course, we do not know which of the versions is correct, but the accumulation of such a huge package of money shows that Buffett does not see interesting opportunities in the market at the moment and that it is possible that he expects the arrival of some bigger problems in the economy.

*****

About XTB

XTB is a global fintech company that provides individual investors with instant access to financial markets from around the world through XTB’s innovative online investment platform and mobile app. The company was founded in Poland in 2004 and currently supports more than 1.1 million customers worldwide in realizing their investment ambitions.

At XTB, we strive to continuously develop an online investment platform that allows our customers to trade over 6,300 instruments including stocks, ETFs, CFDs on currency pairs, commodities, indices, stocks, ETFs and cryptocurrencies. With the recent launch of Investment Plans, a long-term passive investment product, our clients can now tap into the growing potential of ETFs and effectively diversify their portfolios. In key markets, we offer interest on uninvested funds, allowing investors to put their money to work and benefit from it, even when they are not actively investing.

Our online platform is the ultimate place not only for investing, but also for market analysis and education. We offer an extensive library of educational materials, videos, webinars and courses to help our customers become better investors regardless of their trading experience. Our customer service team provides support in 18 languages and is available 24/5 via email, chat or phone.

In more than two decades of activity in the financial markets, we have expanded our reach to more than 1.1 thousand employees. XTB is headquartered in Poland and has branches in many countries around the world, including Great Britain, Germany, Romania, Spain, the Czech Republic, Slovakia, Portugal, France, Dubai and Chile.

Since 2016, XTB shares have been listed on the Warsaw Stock Exchange. We are regulated by the world’s largest supervisory authorities: Financial Conduct Authority (FCA), Polish Financial Supervision Authority (KNF), Cyprus Securities & Exchange Commission (CySEC), Dubai Financial Services Authority (DFSA) and Financial Services Commission (FSC).

More information can be found on the website xtb.com.

Financial instruments offered by XTB are risky. Invest responsibly.

The opening picture source: rawpixel (pixabay.com)

Source: www.nextech.sk